Are You Ready for the On-Off Reality of GLP-1s?

Patients will pause, rebound, and return

Hello and happy Sunday! Was this newsletter forwarded to you? Sign up to get it in your inbox.

I spent this week in my usual café corner with an oat-milk cappuccino, working through the Tony Blair Institute white paper. Between paragraphs I kept flipping to X, reading comments from people thrashing GLP-1s over the weight-regain study. Five minutes to correct the internet turned into a few hours because the internet loves being wrong.

The meta story this week is that everyone is still treating obesity like a sprint while the data keeps shouting it's a marathon. That tension frames every headline below.

And on that note, welcome to the 8th edition of GLP-1 digest. Momentum is building faster than I expected, so thanks for riding along.

Now, let’s dive in.

📊 Inside the Numbers

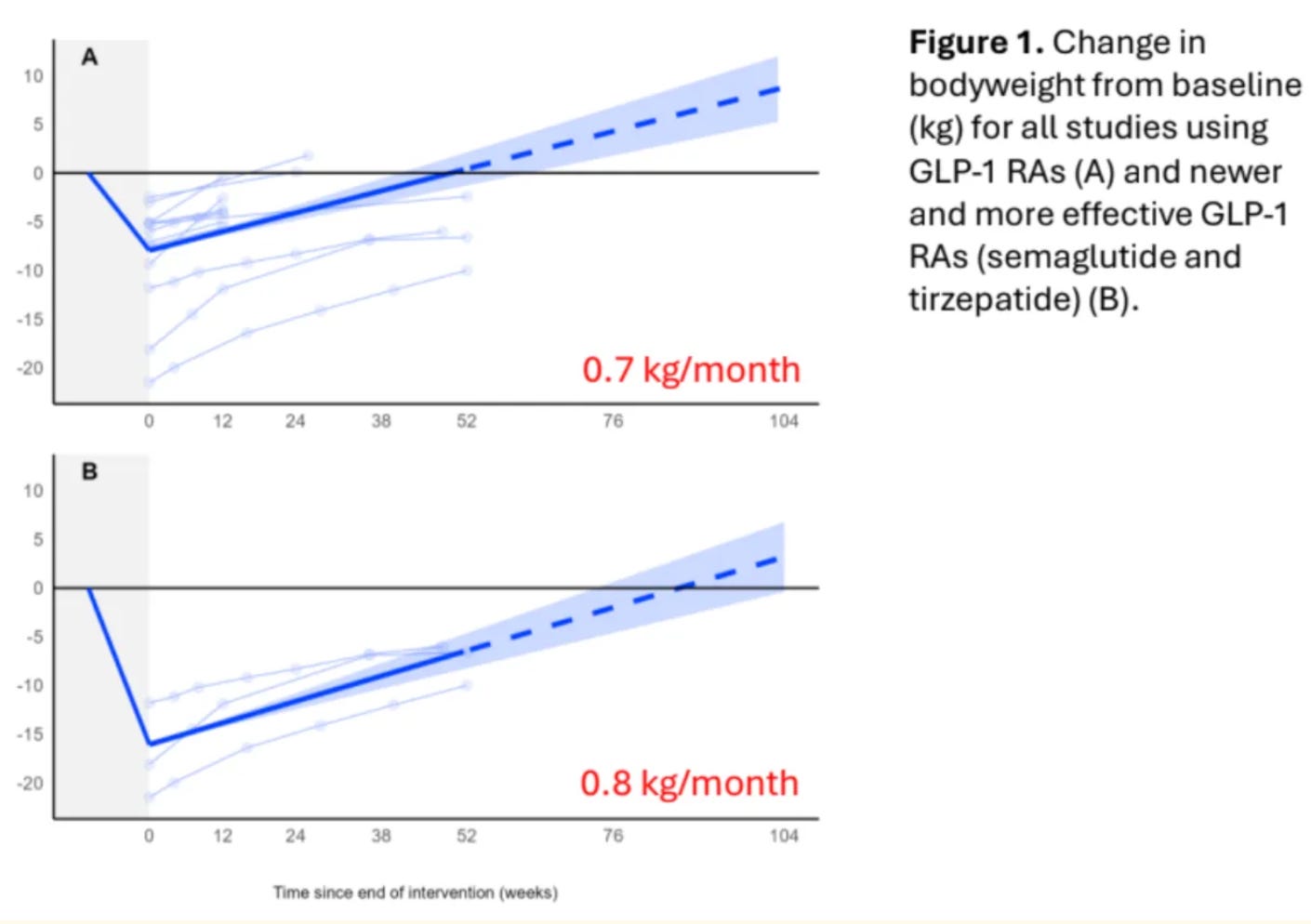

Stop GLP1s and weight rebounds fast — An Oxford meta-analysis tracking 6,370 adults found that stopping semaglutide or tirzepatide leads to weight regain of 0.8 kg per month. At that rate, your 15-20% weight loss vanishes in under two years.

Watching pundits weaponize this data annoys me. A lot. "See? Big Pharma's scam exposed!" they gloat, as if weight regain proves GLP-1s are some type of drug racket

The data shows obesity is chronic disease. Much like if a diabetic skipped insulin, their blood sugar would spike. Or, if a heart disease patient stopped statins their cholesterol would climb. Similarly, if you end GLP-1 therapy your weight rebounds. Medication manages the disease, so when it stops the symptoms return.

Which means treatment is probably lifelong.

And this is the uncomfortable truth we keep dancing around. Accepting it means obesity isn't about willpower or character. It's actually a disease! (I know I repeat myself). But that admission threatens too many assumptions. (Even the NHS won't cross that line.) We're not culturally ready for what that means.

So, you have two choices: pretend this is temporary or build for reality.

Reality means ditching the 12-week before-and-after fantasy for something honest: this is a long-term health investment. One that pays compound returns. Cardiovascular protection, potential Alzheimer's prevention, cancer risk reduction. The data's on your side. Get your marketing teams to tell that story.

Reality also means building choice into your model.

First, make “leaving” graceful. Hims bridges patients to metformin or liraglutide when people can no longer afford expensive GLP-1s (the number 1 reason people quit). Other providers taper down doses gradually. Both options are better than abrupt stops that guarantee weight rebound.

Second, make returning frictionless. Patients will cycle. Three months on, nine months off. Two years on, six months off. This is not a failure, it’s just… life happens. And the winners won't punish returners with intake forms and "starting over." They'll build systems that remember where patients left off and welcome them back. If the data from this study is anything to go by, this is what you need to prepare for.

🔎 Policy Watch

The Tony Blair Institute’s Protect Britain plan sketches an ambitious NHS rollout for anti-obesity drugs — yet I could only focus on one statistic. Online pharmacies ship close to 1 million GLP-1 pens each month and insiders at May’s DICE conference said the true figure is closer to 1.5 million. THAT’S WILD.

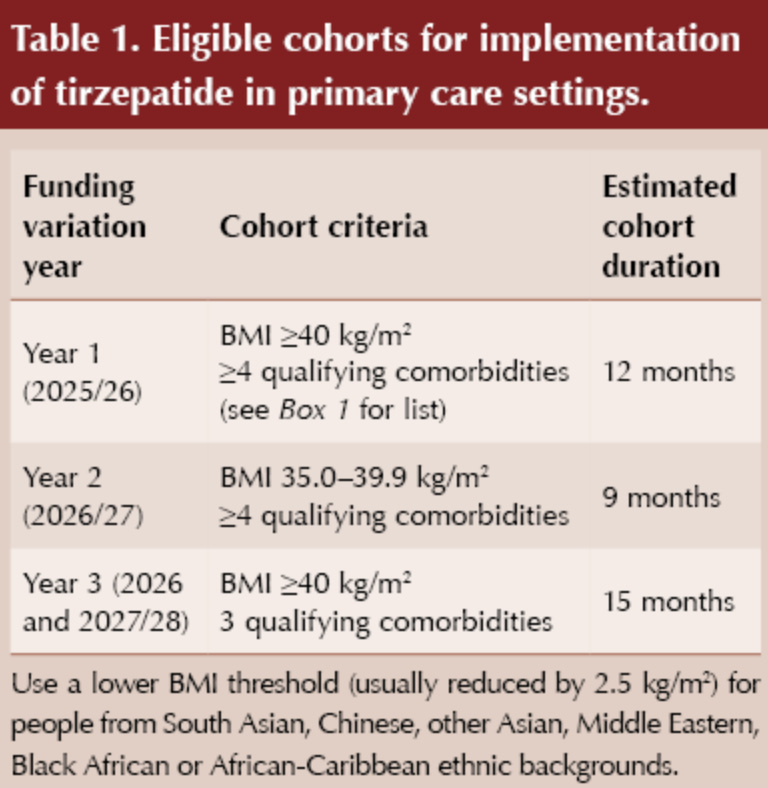

NHS England, by contrast, aims to start just 227,000 people on tirzepatide by 2027 through primary care and another 3.2 million over the 9 years that follow.

At that pace the NHS will treat fewer patients in three years than private providers handle in four weeks.

The scale gap is unprecedented and two design choices by NHS England will keep it that way.

First, eligibility. The NHS restricts primary care access to people with a body-mass index of 40 and above. The product licence already opens the drug to anyone at 27 or above, which is a pool of twenty-six million adults who can turn to online clinics instead of waiting around to see their GP.

Second, costing. And this is where the maths is jaw-dropping. The current proposed care model assumes that one GLP-1 patient (in one year) requires 21 GP appointments, 5 psychologist sessions, 5 dietician visits, four nurse consultations, three pharmacist reviews, one health-care assistant check (and a partridge in a pear tree?!).

That staffing bill lands at £1200 per head, the price of a full year of tirzepatide.

No system can scale on numbers like that.

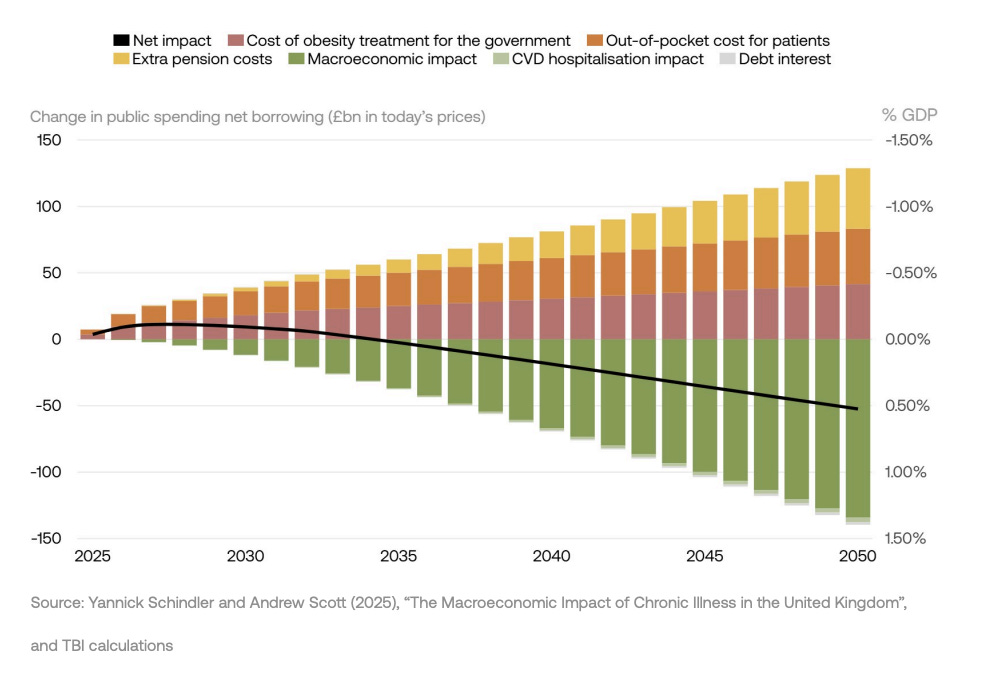

However, online pharmacies already clear both hurdles. The Blair paper urges the NHS to enlist the providers already shipping GLP-1s at national scale. Treasury analysts think this partnership will pay for itself within a decade. Keep it running to 2050 and the books show roughly £52 billion pounds in the green while the economy sits about half a percent larger than it would’ve been. In plain terms the state saves cash and grows GDP by hiring the people who already ship 100,000’s of pens a month.

The sticking point so far has been clinical visibility—many private pharmacists still don’t have access to a patient’s GP record to check allergies, meds, or red-flag history. That changes on 1st October. The new GP contract switches GP Connect to read-only mode for accredited private providers. With a patient’s consent the prescriber can pull the Summary Care Record, spot contraindications, issue the prescription, then drop a structured note straight back into the practice inbox.

The data door is finally swinging open and mass distribution via a public- private partnership becomes a real, viable option.

Takeaway: sharpen your house now. Tight clinical protocols, iron-clad data logs, and a live GP Connect feed are the entry ticket. The NHS will never sign with a pharmacy that cannot show quality governance from day one. Will Whitehall follow the Blair playbook? No guarantee. The politics may (probably) wobble.

Yet the logic is very hard to ignore. The service needs scale, you already have it. Prepared D2C players will be first in line if common sense wins the argument.

🇺🇸 Regulatory Radar

Compounding’s back on the menu, boys — The FDA told 503B outsourcing facilities to stop bulk-compounding semaglutide by 22nd May 2025 or face penalties. Noom—one of the largest tele-health platforms in the US—basically told its members: “We’re not stopping.” They’re betting that personalized, micro-dose titration counts as bona-fide custom care and not copy-paste manufacturing.

Good on them.

Brand pens still drain most out of pocket buyers for $400–$600 a month. Novo’s new discounted price of $199 lasts one prescription, then rockets to roughly $500.

Noom’s compounded prescription sits at a comfortable $149 making it much more affordable for the average American.

Price, though, is only half the story. Personalization really matters. Some patients stall when commercial pens leap from 0.25 mg to 0.5 mg. Others bail when the side-effects spike at higher doses. A 503B pharmacy can mix micro-steps—say, 0.35 mg or 0.45 mg—keeping weight loss moving and nausea in check. That flexibility is of clinical value, not a knock-off.

Legal cover also looks firmer than many thought. A federal judge in Florida tossed Novo Nordisk’s suit against Brooksville Pharmacy once the lab proved three things; it buys semaglutide only from an FDA-registered supplier, follows full cGMP, and fills each vial for a named patient rather than running batch manufacturing. Because Wegovy and Ozempic were no longer on the shortage list, the court said bulk copies are out, yet patient-specific compounding that meets those controls is lawful. Novo’s state consumer claims also fell as preempted by federal law.

That ruling sets an early precedent.

Stick to FDA-registered API, airtight cGMP, and one-patient-one-vial records and a 503B outfit has solid ground. Hims & Hers appears to be working under the same guardrails and is still compounding today. The Brooksville ruling just blew the market door wide open.

I've been on GLP-1s since April 2022 and the short story is: I am alive because of it.

Over and over, I say: "GLP-1s are not a diet!" They are not something to go on, lose weight, then go off, only to regain again. Didn't we do enough of that pre-GLP-1s? I know I did!

You are right. People who chastise us for handing money over to Pharma for no reason, have not one idea how insidious and chronic the disease of obesity is. Your piece is fantastic! Thank you!