GLP-1s go to the Super Bowl

Ro bets big, Novo's oral Wegovy finally arrives, and Hims crosses a line with the FDA

I’ve been away for the past two weeks, so there’s been no digest. But it’s been a good two weeks.

Every January, I spend about ten days at an ashram in South India where I meditate, listen to people talk about spirituality and wonder why the hell I spend the rest of the year plugged into my phone doomscrolling Twitter and constantly consuming news. I think we all have this problem, and I really do recommend taking a pause once in a while so you can reflect on what actually matters. I’m not here to sound preachy, but it really does work.

I also got engaged, which was fantastic. To anyone on the fence, just do it. I look forward to contributing to the overall birth rate shortly.

Now, there’s been an extraordinary amount happening in the GLP-1 space, and it’s time to get into it.

But first…this edition is proudly brought to you by Sacher AI.

Retention is the business problem every D2C weight-loss platform is trying to solve right now. And increasingly, teams are betting on AI coaching to fix it. But the problem is that without genuine clinical depth and experience in this space, you end up with one of two outcomes: an AI agent that plays it so safe it’s useless, or one that crosses lines you didn’t know existed.

Either way, retention doesn’t improve.

Sacher AI is a leading AI consulting firm that I point people to because they’ve solved both sides of this problem. They’ve analyzed thousands of real patient conversations and built systems that know how to retain patients and keep them engaged. Their team includes clinicians who’ve published peer-reviewed research on AI in obesity care.

If you’re building patient-facing AI in this space, talk to Sacher AI first.

100 million eyeballs

This year, a 30-second Super Bowl ad costs ~$20M, and as a rising star in telehealth, Ro will be in the lineup. Ro’s founder Zachariah Reitano explains why 100M eyeballs are worth at least the $233,000-per-second price tag.

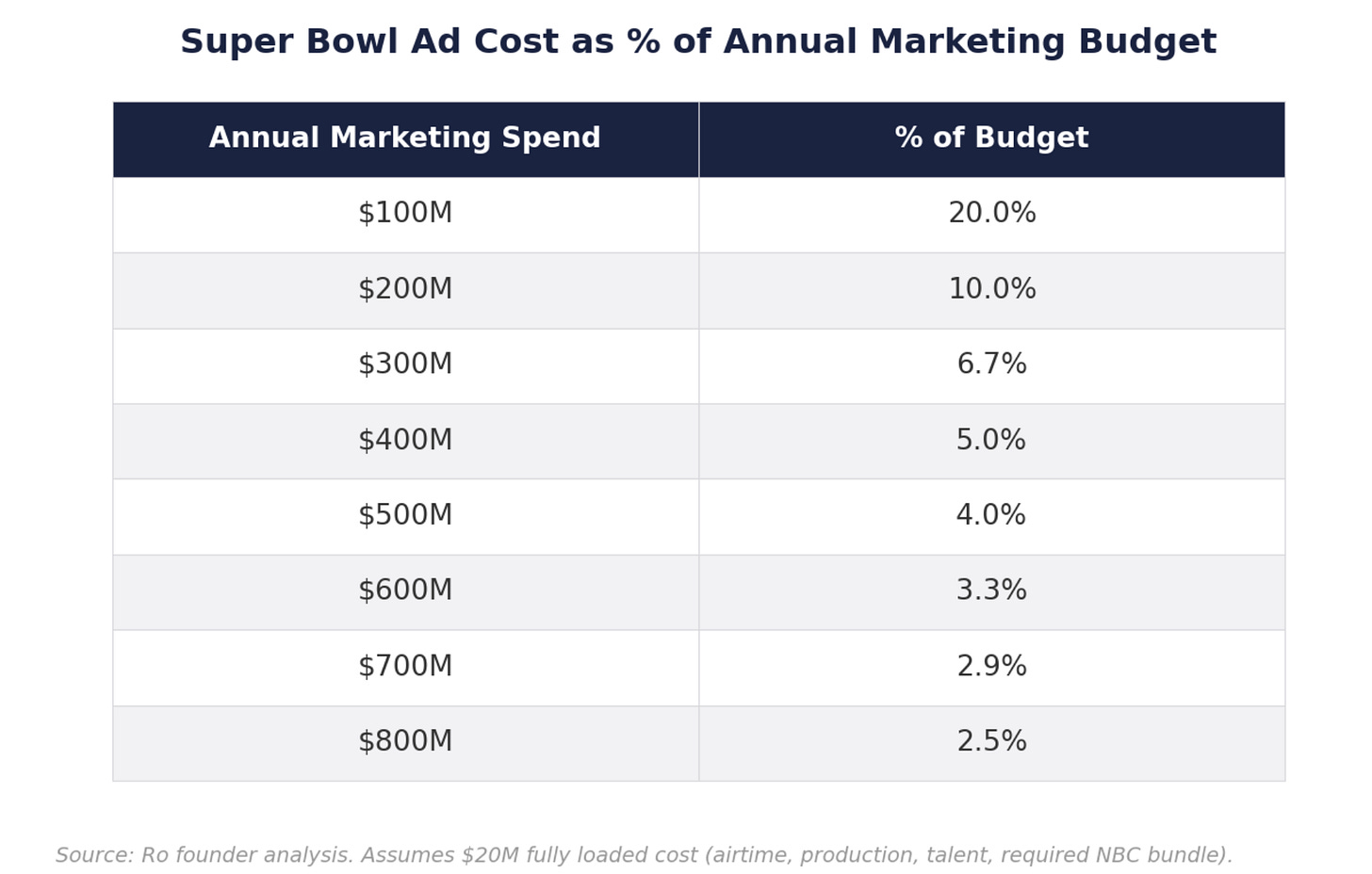

His main argument is that the company's marketing budget is large enough that the ad spend is a tiny percentage of the whole, which caps the downside but makes the upside potentially ginormous.

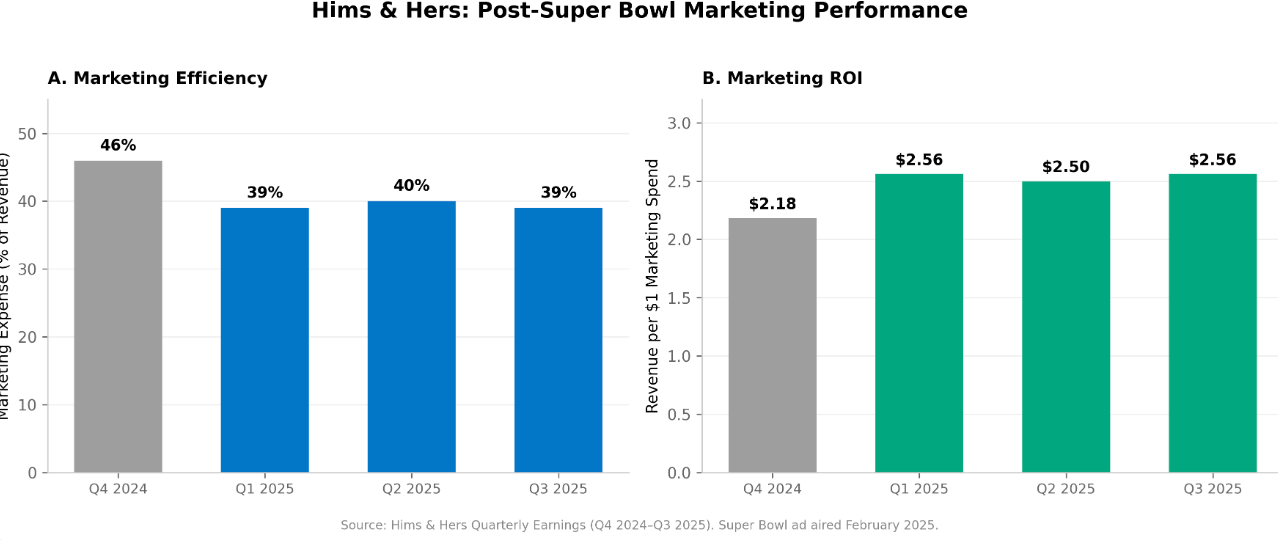

Reitano has compelling evidence to believe this is true. Hims & Hers, Ro’s biggest competitor, ran a Super Bowl ad last year that ruffled a lot of feathers and increased the company’s marketing efficiency by approximately 17%, quarter on quarter.

In other words, the net effect of their 2025 Super Bowl ad was that every new customer thereafter was 17% cheaper to acquire. Every marketing dollar went further, and that’s why Hims & Hers is running another Super Bowl ad today (sure to ruffle many more feathers).

With their first-ever Super Bowl ad spot, Ro is hoping to generate a similar effect.

Given Hims’ & Hers’ success, throwing $20M in the pot is sort of a no-brainer for Ro, even if their ad were to flop.

Ro hasn’t disclosed their marketing budget, but I have reason to believe that it’s massive (if you’re closer to the numbers than I am, hit me up in a reply to this newsletter).

Let’s say they’re working with a $700M marketing budget that brings in 700,000 customers at a $1000 customer acquisition cost (CAC). If people hate seeing Serena Williams say “Ro” six times in the space of 30 seconds (I counted) and the ad flops, Ro’s CAC would only increase by $29 (~3%).

Given Ro’s size, that’s like a mosquito buzzing around your ear at night when you have the mozzy net up. It’d be annoying, but you wouldn’t die.

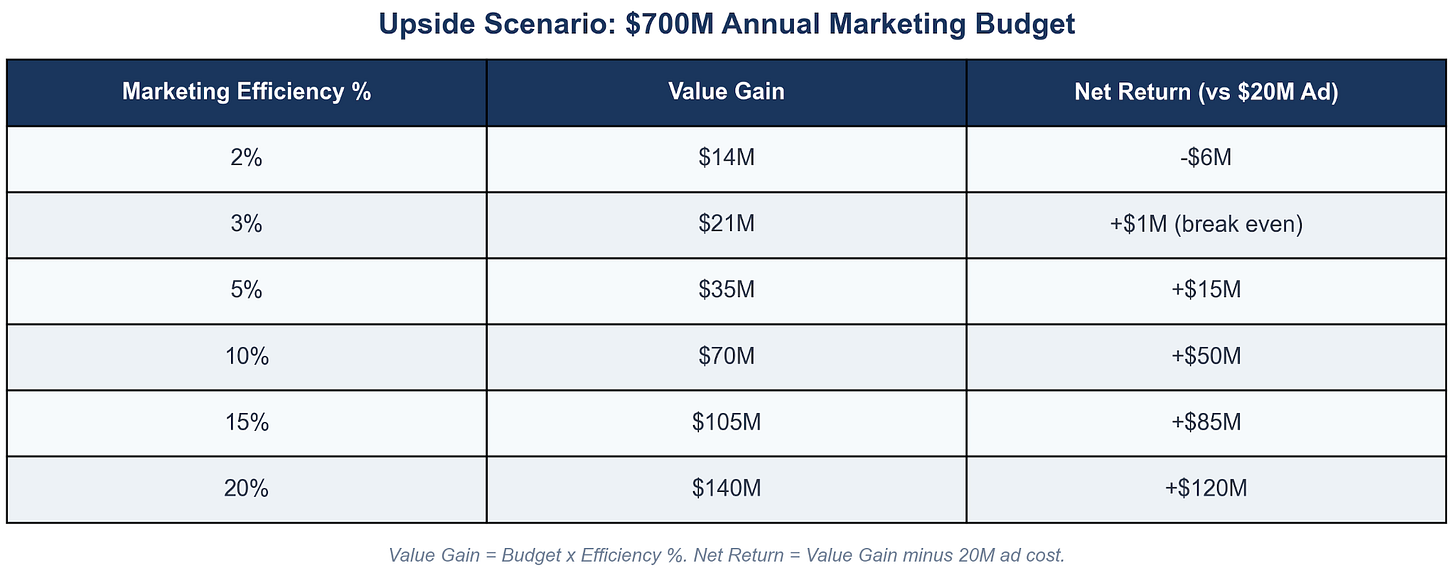

What’s much more juicy and compelling is the marketing upside over time. Let’s assume the Super Bowl ad is a raging success and moves the needle in a bunch of ways that compound across every marketing channel for the next year.

In reality, this means Ro’s ads get clicked more because people recognize their brand. Or, their landing pages convert better because there’s already trust. Or people start Googling “Ro GLP-1” directly instead of “GLP-1 near me,” which means Ro isn’t paying for that click. Or people start referring their friends, which are the ultimate zero-CAC customers.

So, what marketing efficiency increase would Ro need to gain for outsized returns? Not much, as it turns out.

With a $700M marketing budget and $1000 CAC, a 15% efficiency improvement would mean a return of $85M in marketing cost savings. That’s almost the same as launching an entirely new product category, like HRT or TRT, in terms of the revenue generated.

Is it likely, though?

Very much so. If you think of the Super Bowl as a way to get cheap clicks later, then the repeat buyers are the proof that cultural capital compounds. Squarespace wouldn’t come back 12 years in a row if the unit economics were terrible, and neither would Pfizer or Budweiser. The fact that Hims & Hers is back after their Super Bowl controversy is arguably the strongest signal that the investment pays off.

Oral Wegovy is already a blockbuster

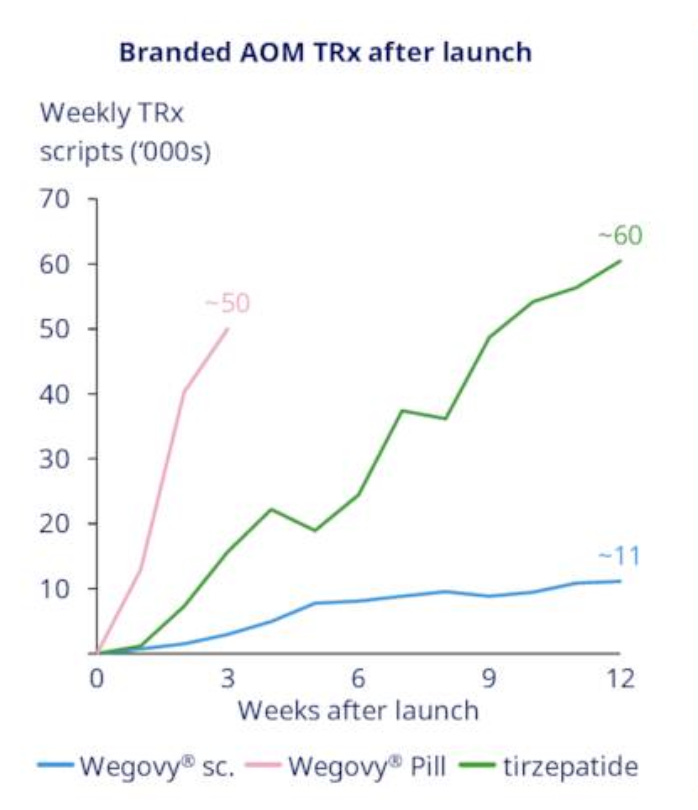

Ro is advertising at the right time to the right audience, since the oral Wegovy tablet is flying off the shelves. With 50,000 scripts sold in the first 3 weeks, the Wegovy pill launched at more than 2x the pace of Zepbound and 4x injectable Wegovy.

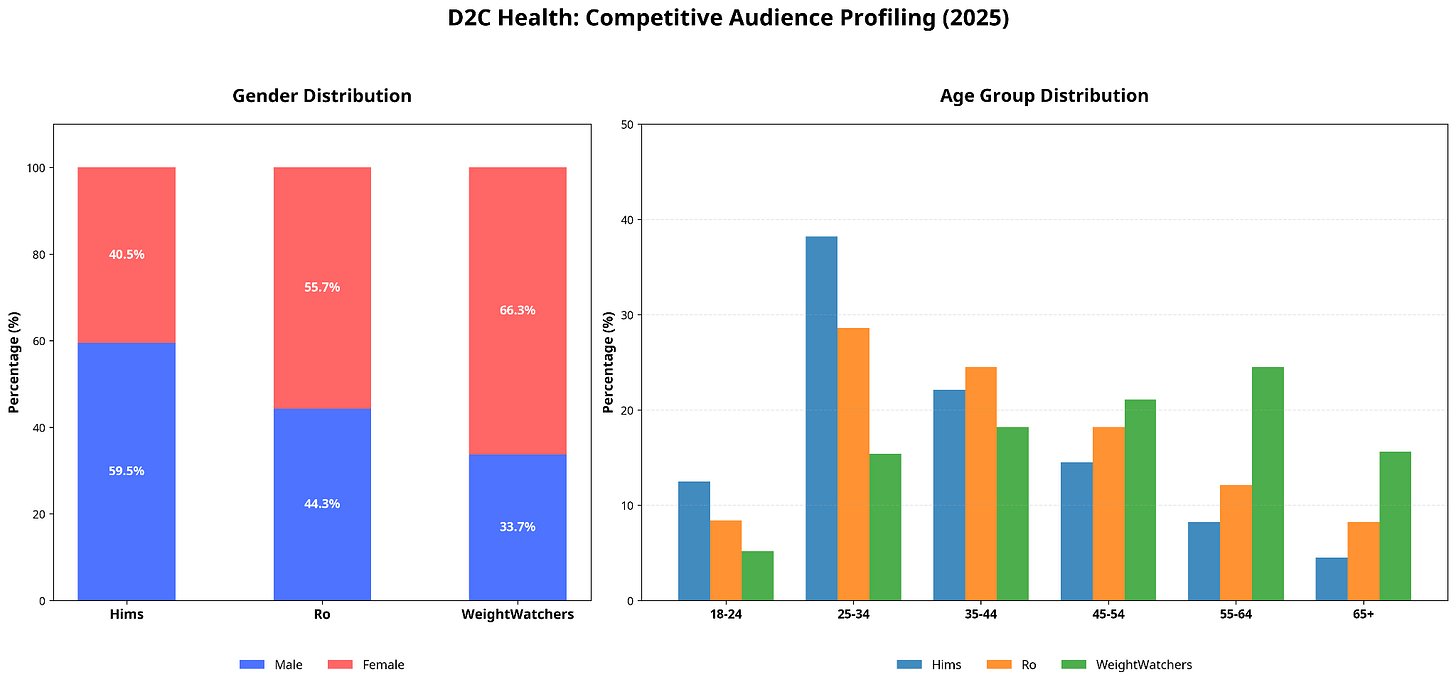

Also, Ro’s data shows that more working-age men are taking the oral semaglutide than expected, which is a demographic that is very likely to watch the Super Bowl.

Novo Nordisk makes Wegovy, and Ro is one of the key direct-to-patient channels Novo is using for the nationwide rollout of their new pill, meaning Super Bowl viewers can see the ad and then actually complete the journey on Ro with minimal friction.

The timing is *chef’s kiss* perfect.

I would also bet that Novo Nordisk will run its own Super Bowl ad for oral Wegovy, and that ad won’t compete with Ro’s message but, rather, validate Ro as the way to get the new pill.

But, here’s where things get dicey.

Hims & Hers crosses several lines

On Friday, the FDA announced its intent to restrict GLP-1 active pharmaceutical ingredients used in compounded drugs, warned that companies can no longer claim their products are generic versions of FDA-approved medications, and made clear that failure to comply may result in seizure and injunction without further notice.

This is the strongest and most unambiguous statement I’ve seen from the FDA on compounded GLP-1s. Hims & Hers are explicitly named by the commissioner, which tells you everything you need to know about how much they've poked and prodded the bear.

This statement was triggered by Hims launching a compounded oral semaglutide tablet at $49 a month, undercutting Novo’s oral Wegovy by $100.

The main issue is that the Hims pill almost certainly doesn't work.

Without SNAC, the patented absorption technology that Novo Nordisk spent three decades and $1.8 billion developing, roughly 99.9% of oral semaglutide gets destroyed in your stomach before it reaches your bloodstream. Hims doesn't have access to SNAC, and instead, was supposedly using an untested liposomal delivery technology with zero human clinical data behind it.

This launch was a reckless move, and I have never seen this level of condemnation from investors, healthcare professionals, and regulators simultaneously directed at a single product launch. As a result of the backlash, on Saturday 7th February, the Hims & Hers PR team announced they are going to stop offering access to their compounded oral treatment.

It still remains to be seen what happens with the FDA now that Hims has pulled the product. The FDA’s enforcement toolkit runs from warning letters all the way through to injunctions, product seizures, and criminal referrals to the Department of Justice.

I expect they may still go for an injunction, which is essentially a court order that forces Hims to stop manufacturing, distributing, or marketing compounded semaglutide until they can demonstrate compliance with the Federal Food, Drug, and Cosmetic Act.

What I don’t know is if this means the jig is up just for the oral compounded pill or compounded semaglutide in general, and hopefully we’ll get a clearer picture in the coming days.

Nonetheless, Hims & Hers are in damage-control mode, and they have seriously tarnished their reputation. The stock is the lowest it’s been since 2024, and this whole saga will make it painful to watch their Super Bowl ad today. The ad itself is a wonderful piece of marketing that gets to the heart of why accessibility matters in healthcare, and on that message, they’re absolutely right. Millions of people are priced out of treatments that could change their lives, and someone should be fighting to fix that.

The problem is that you can’t run a Super Bowl ad about making healthcare accessible to everyone while pulling a sham pill off your website the day before.

Unfortunately, it’s going to cost more than $20M to regain that trust.

Wait, I have to talk now too?

When I started writing this newsletter, I didn’t expect it would also mean speaking. But over the past few months, I’ve been on something of a podcast tour, and it’s been a helluva lot of fun.

I recently sat down with Stephen Dubner, the bestselling author of Freakonomics and host of one of the most popular podcasts in the world, Freakonomics Radio.

It was one of the most incredible experiences of my life, with some tough questions thrown into the mix.

Listen to our conversation on the suffering economy and the GLP-1 landscape.

I also joined Paul Cerro, the founder and CIO of Cedar Grove Capital Management, a hedge fund based in Michigan. We dug into Hims & Hers, telehealth, and the compounding market. What’s crazy is that basically everything we discussed has since played out. If you want a preview of where this space is heading, that conversation is a good place to start. Listen here.

All of this has convinced me to launch my own podcast, where I’ll be going deep on these topics with some brilliant guests.

Expect that very soon.

**The views, opinions, and recommendations expressed in this essay are solely my own and do not represent the views, policies, or positions of any other organization with which I am affiliated. This content is provided for informational purposes only and should not be considered medical, legal or investment advice.**