Hims is Quietly Building a Consumer Health Empire

What their Q1 earnings call reveals about the future of D2C healthcare

Hello and happy Sunday!

This week’s digest is a little different. I’ve taken a deep dive into Hims’ Q1 earnings call because, frankly, it was loaded with insights every founder, operator, and investor needs to hear.

Interestingly, the real gems weren’t only in what management said, but in everything they strategically left unsaid.

Consider this your shortcut. I don’t want this to be a bland earnings rehash, but an insight-packed breakdown of how Hims is setting the pace not only in GLP-1 treatments, but in D2C consumer health as a whole.

I enjoyed putting this together and, yes, unapologetically nerded out in the process. Send me a DM to let me know what you think.

Right, let’s get straight to it.

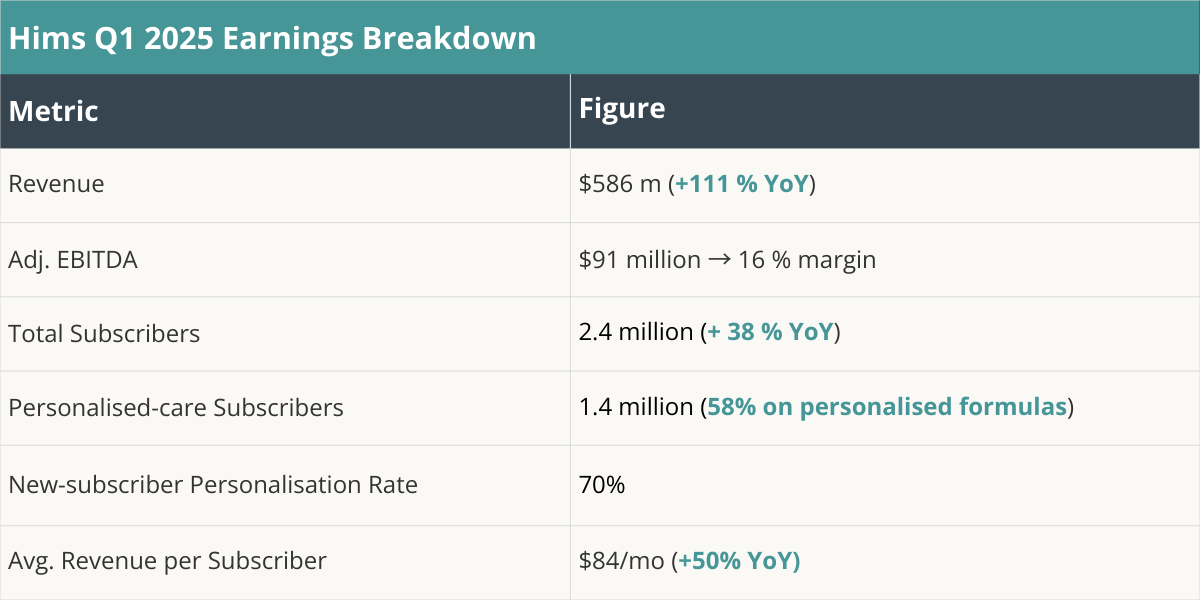

On the surface, Hims’ revenue growth looks pretty damn impressive. But, don’t get too comfortable. A dip is coming.

Throughout January and most of February, Hims was practically printing money with compounded semaglutide prescriptions until the FDA stepped in and ended the party. To their credit, management saw this coming and quickly pivoted into offering cheaper oral kits and liraglutide treatments to build a safety net for when the easy money inevitably dried up.

Q2 will be the real gut check. Will Hims keep their weight-loss subscribers now compounding has basically ended? Personally, I expect they'll hit a noticeable dip that'll knock the stock price.

But investors shouldn’t panic.

Management confidently expects at least $725m in FY-25 weight-loss revenue—which is around one-third of total sales. Sure, that number is partly damage-control theatre, but I bet they'll actually land it.

This is because Hims is not done announcing big pharma partnerships, and a Lilly deal feels imminent (more on that shortly).

📈 Subscriber Quality is Hims' Real Secret Weapon

Believe it or not, business exists beyond GLP-1s. (Who even am I at this point?). Sexual health is becoming equally strategic for telehealth players.

Let me break down exactly why:

About 40% of Hims’ ED customers don’t buy one-off Friday night pills anymore. Instead, they're taking daily capsules that pair ED meds with something extra like testosterone, cholesterol or even hair growth support.

This is a genius play because it moves ED from being a discreet lifestyle purchase to something seamlessly integrated into your daily health routine. Like brushing your teeth. (Just don't use Cialis as toothpaste).

This does three very, very good things for Hims:

1. Lifetime Value (LTV) jumps

Daily pills make people stick around way longer. After one year, Him’s reported that 10% more daily users are still subscribed compared to guys who just buy pills occasionally.

The enhanced loyalty reduces churn and has a second order effect of reducing Customer Acquisition Cost (CAC) spend.

When users stick around longer, the marketing dollars you spent to acquire them get earned back sooner. This frees cash to reinvest in growth, which Hims is doing with new treatment modalities like Menopause support and Testosterone replacement therapy (TRT) briefly mentioned in the earnings call (planned launch H2 2025).

2. Habit Hooks and Holds

If your daily pill is personalised specifically for your needs (say, ED and cholesterol), switching back to a generic option feels like a real step backwards (like going from Netflix to cable).

Without realizing it, you've built a daily ritual that locks you into the Hims ecosystem. Paying a premium for personalised care just starts feeling natural. Obvious, even.

Reading between the lines, CEO Andrew Dudum basically spelled it out on the earnings call:

"Over the next five years, we'll focus on 5 core drivers of growth. First, we will deepen personalisation capabilities, enabling access to a more precise level of care. Our vision involves expanding from hundreds of personalised treatments today to potentially thousands….

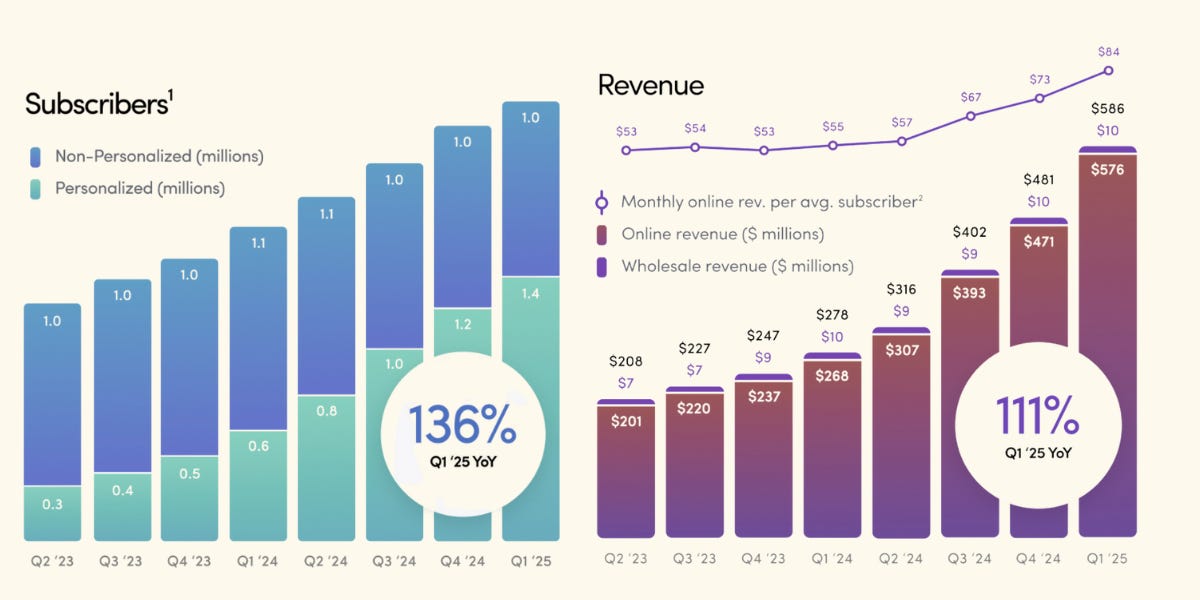

Already, over 70% of new Hims subscribers choose personalised treatments from day one, pushing average monthly revenue per user to $84—up a massive 50% from last year. This is exactly what you'd expect from customers who feel like they're getting real, tailored value.

3. Bigger, stickier market

What most founders and investors haven't quite grasped yet is that ED is just a Trojan horse.

What Hims is really doing is using the ED pill as a daily anchor, then quietly layering in support—sometimes full-on treatment—for long-term issues like cardiovascular health (endothelial support), metabolic tuning (lipids), hormone balance (low T), sleep quality, and potentially even low-grade anxiety.

The real play then is turning one-off, “Friday-night” buyers into loyal subscribers who take a daily health stack.

Those add-ons start as simple performance enhancers, but, I suspect over time, will shift the relationship into true chronic-care territory. This will slowly make Hims a comprehensive, subscription-based health platform. And potentially, a chronic-care platform in disguise.

Founders, in short: if you can master the art of compounding for long-haul conditions then you've captured something really, really special.

If you can't deliver on a seamless, daily habit-forming dimension, you'll find yourself playing catch-up as competitors who can, and will, completely dominate the D2C landscape. Time to line up a rock-solid 503A/503B compounding partner—or build the capability yourself—before someone else locks in your customers.

🩸Your blood is Hims’ goldmine (and Eli Lilly is probably jealous)

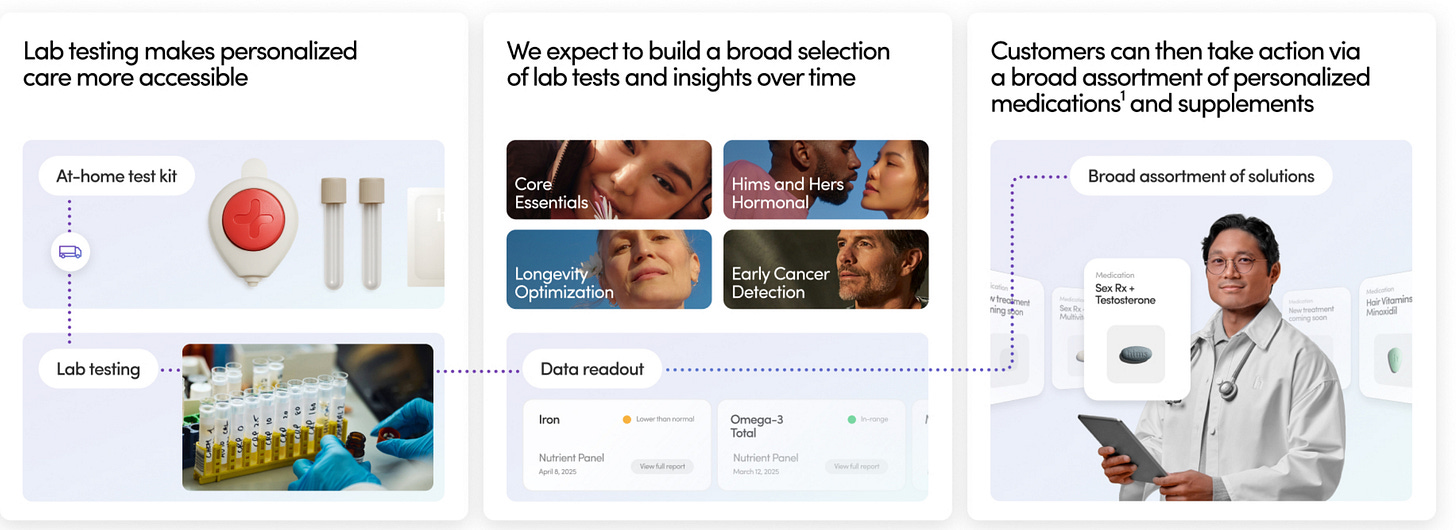

Hims just snapped up an at-home lab-testing company that lets customers run blood tests at home for stuff like heart, liver, thyroid, prostate, and testosterone markers. The move signals (loudly) Hims' broader ambition which is controlling the recurring diagnostics essential for TRT and HRT treatment, and strategically cross-selling to their existing ED and GLP-1 customer base.

These demographics fit together almost perfectly, and will lock customers deeper into the Hims ecosystem.

Even better is how all that juicy biomarker data will flow straight into MedMatch, Hims’ AI engine, which’ll sharpen its recommendations so it can nail the right prescription the first time.

Big Pharma will be drooling over this and is exactly why Novo rushed in first.

Hims can spin up millions of real-world datapoints, biomarkers, dosing, adherence, faster than any traditional trial. That real world evidence is gold.

Here’s (almost certainly) how the Novo deal is structured:

Novo gets an anonymised, Wegovy-only data feed—adherence curves, side-effect flags, outcome markers.

No peek at other drugs or patient cohorts.

Hims keeps the master dataset and slices it by brand.

Lilly will 100% want a parallel feed for tirzepatide. Which is why I’m confident that a Hims-Lilly announcement isn’t far off and why stocks in both companies will surge.

🚢 The Compounding Ship

On top of their data play, Hims is rapidly scaling a 700,000-square-foot sterile compounding facility. Think thousands of custom drug combos spun up, tested, and shipped (or scrapped) in weeks instead of months, completely in-house, lightning-fast, no middlemen.

CFO Yemi Okupe describes it as unlocking a "platform for future specialties."

They've even hired logistics ace Nader Kabbani as COO who previously ran Amazon Kindle's blisteringly fast print-on-demand machine—to ensure the operation runs like clockwork. Basically, exactly the ruthless efficiency you'd want if you were plotting total healthcare logistics domination.

What this signals: D2C is moving from fringe to frontline care. When patients can test at home, get an AI-matched script, and have a custom dose on their doorstep in days, traditional care channels start looking very dial-up slow. I don’t want to say Hims is building the amazon prime of healthcare because its super cliche but it basically kind of is.

📷 CAC is falling because organic finally clicked

Hims' investments in brand-building, SEO, and word-of-mouth are finally paying off. Their marketing spend has dropped significantly to just 39% of revenue, meaning they no longer need to heavily rely on Google, Meta, or TikTok ads to fill their funnel.

As CFO Yemi Okupe put it, "more subscribers are coming through organic and lower-cost channels."

The takeaway for founders and operators: stop treating paid ads as your main growth lever. It's a short-term sugar rush that's getting less sweet (and more expensive) every year and is exactly what health tech writer and investor, Christina Farr, warned about.

You might argue Hims is an outlier here, and that's fair—but they're demonstrating exactly what's possible with time and patience when organic growth finally starts clicking.

What I'd do: create content so genuinely useful and insightful that people willingly share it.

Answer the actual questions your customers are asking, instead of mindlessly spamming keywords.

Focus on EEAT (Experience, Expertise, Authoritativeness, and Trustworthiness) and seriously, read Farr's & Flanzraich’s piece on how to obtain good, organic growth.

Conclusion

Hims is methodically building the infrastructure and strategy to dominate consumer health. Personalised compounding, hyper-specific biomarker data, sophisticated AI-driven treatments, pharma partnerships…they’re putting it all under one roof.

As a founder, operator, or investor, you really have only two options: meticulously study their playbook and leverage their moves to fuel your own innovation, or quite literally sit back and watch them rewrite the rules of D2C healthcare without you.