How GLP-1s Are Breaking Life Insurance

Patients look healthy on paper. Two years later, they're high-risk again.

Hello and happy Sunday! Was this newsletter forwarded to you? Sign up to get it in your inbox.

I've just got back from HLTH in Amsterdam, nursing what might be the worst three-day hangover of my adult life. Worth it, though. It's one of the best health tech events in Europe, and I made some genuinely great connections.

If you’re ever at a large health conference, here’s a neat little hack I learned: Be brave enough to ask questions during panels. It's terrifying, but suddenly everyone knows your name, your company, and that you've got enough spine to speak up in front of 200 people. Makes the networking infinitely easier afterward.

Now, while everyone else obsessed over AI (shocking, I know), I was laser-focused on GLP-1s. One throwaway comment during a private equity panel sent me down a rabbit hole on insurance companies grappling with the weight-loss drug explosion.

The downstream effects are completely fascinating and completely overlooked. I spent the rest of the conference hunting down insurance people who were all asking the same question: how the hell do we deal with this?

Turns out, they have good reason to panic.

Life insurers can predict when you'll die with about 98% accuracy.

This ruthless precision comes from from decades and decades of mortality data they use to figure out how much to charge you every year, so that the money they earn (from you and by investing your premiums) will easily cover what they'll need to pay out later.

Of course, not everyone gets the same deal.

Underwriting is the dark art that allows an insurer to figure out if you're a good bet or a risky one.

Typically, underwriters- suspiciously sounds like undertakers-rely on a handful of key health metrics like HbA1c, cholesterol, blood pressure, and BMI to calculate your risk of dying earlier than expected (and thus costing them money).

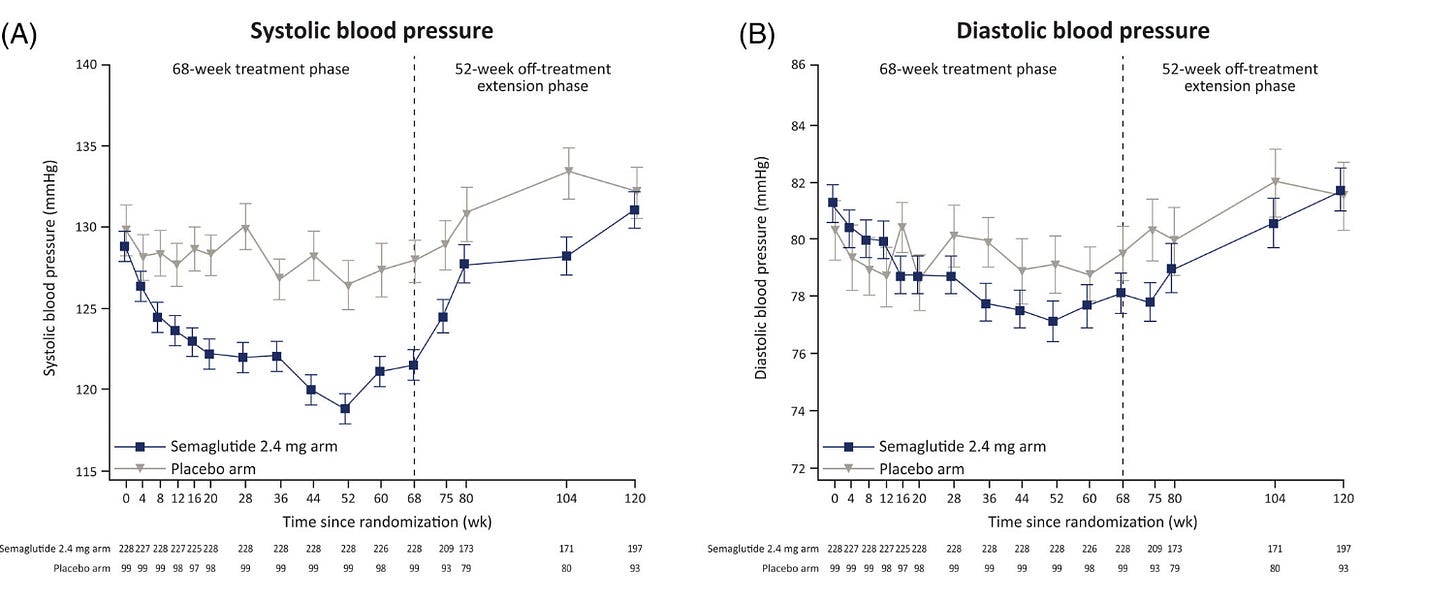

Those eagle-eyed readers among you have probably noticed something interesting already. Those same four metrics are exactly what GLP‑1s improve. Not just a little, but enough to entirely shift someone's risk profile within at least 6 months of using them.

So, what’s the issue?

Let’s say a 42-year-old applies for life insurance:

They self-report a BMI of 25 (healthy)

No visible co-morbidities in claims data

No prescription record shows Sema/Tirzepatide

Labs within normal range

The insurer sees a ‘mirage’ of good health and approves them as low-risk.

But in reality:

They were obese a year ago (BMI 32)

Lost around 14kg using GLP-1s from a D2C provider (no detail on their electronic health record)

Still have underlying metabolic syndrome

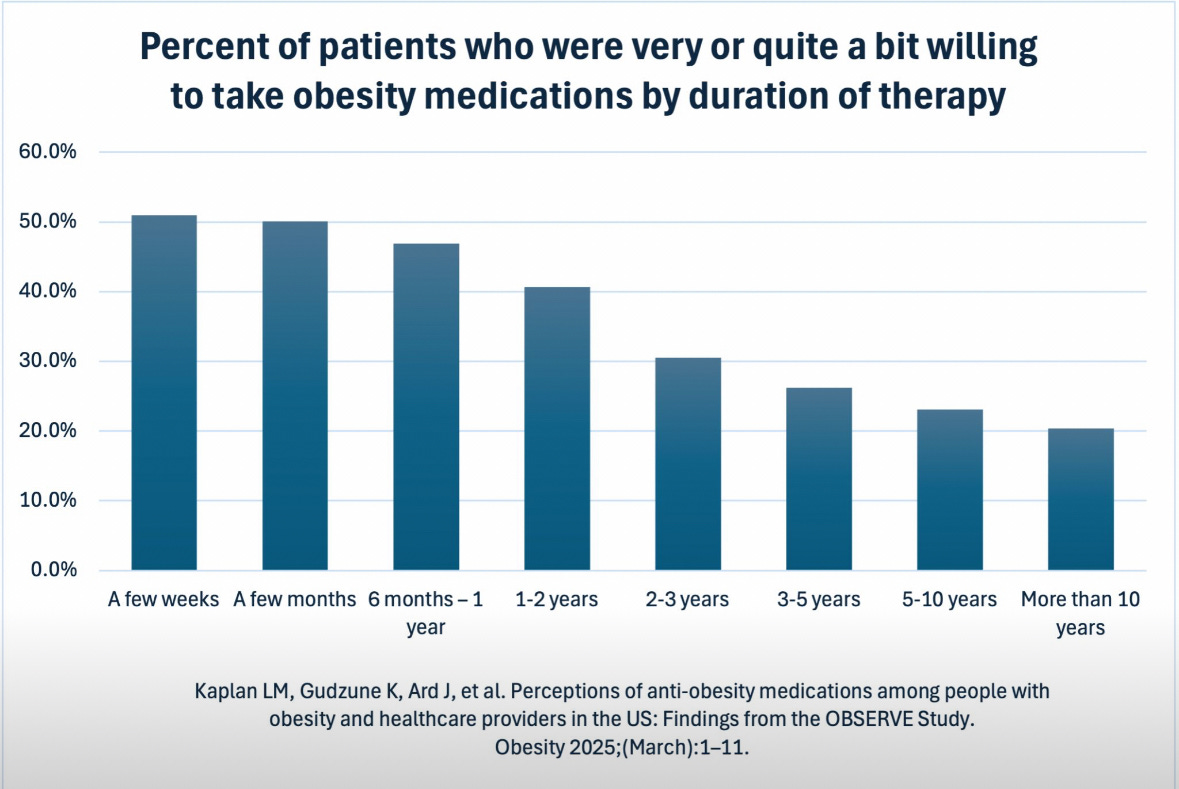

If we assume about 65% of people who start GLP-1 medications quit by the end of year one, that creates a big problem. When someone stops the medication, they'll usually regain the weight they lost, and in two years, most of those key health indicators (like BMI, blood pressure, blood sugar and cholesterol) bounce back to their starting point.

This means the underwriter has just locked in a 30-year policy at preferred rates for someone who'll be high-risk again by year three.

Insurers call this type of screw-up "mortality slippage."

Mortality slippage means accidentally classifying someone as lower-risk than they actually are. It's ridiculously expensive. A single mistaken classification can cost insurers millions in unexpected payouts over the life of a policy.

And it's getting worse. Fast. Mortality slippage has exploded since 2019, nearly tripling from 5.8% to a staggering 15.3%. That means one in six life insurance policies is fundamentally mis-priced.

How are insurers responding?

The first thing insurers are doing is changing their assessments.

Instead of asking something vague like “How much has your weight changed in the past 12 months?”, which forces you to think hard and guess and probably lie, underwriters are using a behavioural-science technique called anchoring to simplify things.

Now, they'd say something like, “In the past 12 months, has your weight changed by more than 10kg because of weight-loss medication?” By adding a clear reference (the "10kg" anchor), underwriters make it easier and more likely for people to answer truthfully.

If you answer honestly (many don’t), insurers are responding in one of three ways:

Denying coverage completely

Requiring proof you can sustain weight loss on GLP-1s for at least a year

Adding 2-3 BMI points to your risk profile as a safety buffer

Of course, these are band-aid solutions to a retention problem. And retention problems create massive business opportunities

The Real Money

Right now, insurers see GLP-1s as short-term weight-loss tools because that's exactly how patients treat them.

But we know that there’s rock solid data showing continued GLP-1 use does significantly reduce obesity, cardiovascular disease, and overall mortality (indirectly).

In other words, better adherence leads to healthier patients who cost insurers far less over the long term.

Insures are already starting to hunt aggressively for these partnerships because this stabilizes their financial projections and reduces expensive claims down the line.

These partnerships could easily become multimillion-dollar deals, once generics and new GLP-1 entrants push prices down, opening the door to serving hundreds of thousands of customers every month and making this a fantastic win-win-win situation for patients, insurers and private companies.

But at HLTH, when I asked how companies planned to actually deliver this retention, all I heard were vague promises about "wrap-around care" being some kind of magical bullet.

When pressed for specifics—or actual, hard data proving it works—I didn't get a single convincing answer.

Don’t get me wrong. I do agree with the value of wrap around care. I do.

But my issue is we tend to overcomplicate solutions because we're drawn to elaborate, multi-layered strategies (umm, look at how much the NHS spent on McKinsey) when simpler fixes have worked brilliantly in the past.

If we look at statins, there was clear evidence they prevented heart attacks, yet patients kept quitting on them.

The industry wrung its hands about "patient education" and "compliance programs" while completely missing the obvious solution.

Make getting them less of a pain in the ass.

They switched from 30-day to 90-day refills. Suddenly, patients had to think about their medication four times a year instead of twelve. Adherence rates shot up almost immediately.

The same principle could be applied very powerfully to GLP-1 meds.

Alongside thoughtful wrap-around services, there's enormous value in:

3 month bundles of the same dose of medication

minimal friction for restarting paused treatments

behavioural nudges like text notifications

I think this would have an immediate impact & cost much, much less for the patient and for your margin.

Conclusion

Right now, insurers are getting fooled by mirages of good health that disappear when people quit treatment. The companies that turn those mirages into reality, by you know, actually keeping people on medication, will be solving a problem that insurers will want to throw money at.

But this window won't stay open forever. Insurers are already adapting, asking harder questions, building better detection systems. The first movers who crack retention before insurers figure out their own solutions will capture the entire market and become the industry standard.

The statin playbook worked 20 years ago. It'll work again today, but only for those who execute it first.

Is nobody here going to talk about the OBVIOUS reason people stop?

I have just completed a year on tirzepatide. I paid for it using the proceeds of a viral story from a year ago. That’s gone and some steady freelance work that used to bring in a thousand bucks a month just evaporated. I no longer have a way to pay for these drugs. Insurance won’t cover them. I am looking at purchasing from the gray market or seeing if I can maintain by stretching doses to one shot a month. I’m four pounds from a normal BMI and would be fine with this weight. Lost 68 pounds in a year without changing a thing. My diet was already pretty close to optimal and still is. I feel satisfied with slightly smaller portions and don’t experience food noise. I have the same relationship with food as my always-slender adult kids now.

I’m not going to go back to where I was a year ago. I will do whatever it takes. I’d sooner be homeless, and that’s not out of the question.

Great post. To totol aside, but agree on asking questions and even better ask something that challenges the panel - not debate but get them to say “that’s a good point “ or “glad you asked “.