Stop Calling GLP-1s a Trend

83 % refills, $2.2 B pill deals, Saudi production lines. The fad died; the utility was born.

Hello and happy Sunday! Was this newsletter forwarded to you? Sign up to get it in your inbox.

This week I spent my evenings hunched over my laptop, sifting through a ridiculous number of conference abstracts and niche industry reports. Definitely not glamorous, but someone’s gotta do it (my optometrist wishes it wasn’t me).

Welcome to the 7th edition of the GLP-1 Digest.

The meta story this week is that there's a quiet but powerful shift happening right now in the GLP-1 space, and most people haven't noticed it yet.

Pharma giants are placing billion-dollar bets, regulators are cracking down on telehealth loopholes, and new data is showing patient behaviour moving from curiosity to commitment. Suddenly, GLP-1s aren't looking like trendy quick-fixes anymore.

Let’s dive in.

📊 Inside the Numbers

IQVIA dropped some fascinating GLP-1 insights last week — You probably missed them because they were buried in PDFs thicker than my copy of Gray’s Anatomy, a book I’ve opened exactly twice (once by mistake).

Three nuggets worth your attention:

Out of the 15.5 million obesity-related GLP-1 prescriptions filled in 2024, roughly 12.87 million—or a hefty 83%—were renewals. This means the vast majority of patients aren't dabbling around anymore, they’re actively continuing GLP-1 treatments.

Even more surprising was that new patients who started a GLP-1 prescription stayed on therapy for an average of 231 days (around 7.5 months). That’s impressive, given recent open-network studies flagging steep patient churn around the 3-6 month mark.

Why the stickiness?

After 18 months of non-stop headlines—good and bad- GLP-1s have officially graduated from whispered gossip to full-on dinner-table talk. Your aunt, your gym bro, that longevity-obsessed colleague (guilty). Everyone’s starting to get it. New data keeps surfacing, showing these meds will of course help you drop weight, but they will also cut your risk of heart attacks, strokes, and maybe even cancer. People are finally waking up to the fact that GLP-1s are serious, long-term investments in their health and lifespan.Men account for nearly half the obesity-affected population in the U.S., yet they're picking up just 24% of obesity-related GLP-1 prescriptions. Women absolutely dominate with a whopping 76%. This is a huge and potentially lucrative gap that's screaming for smarter, targeted strategies for men’s health. To win the male segment, push performance, wellness, and the testosterone bump that weight loss brings.

Everyone’s buzzing about SURMOUNT-5 — But we already knew tirzepatide beats semaglutide. What's much more interesting is that women lost roughly 6% more weight than men on GLP-1 meds at every single stage.

Are biological sex differences at play? Possibly. Research hints at women having higher baseline GLP-1 levels and Oestrogen may boost receptor sensitivity—potentially giving them an extra boost.

However, I really want to exercise some nuance here. SURMOUNT-5 included roughly double the number of females compared to males, which might’ve amplified sex differences. Also, unexamined variables, like baseline metabolic profiles or co-morbidities might’ve also influenced these results.

The bottom line is that we’re still in the hypothesis-generating stage of why women lose more weight than men on GLP-1’s. And now here’s where I get to sound very smart and say what every researcher loves to say: “we need more research”. Still, I’d keep a close eye on this.

🚨 Big Moves

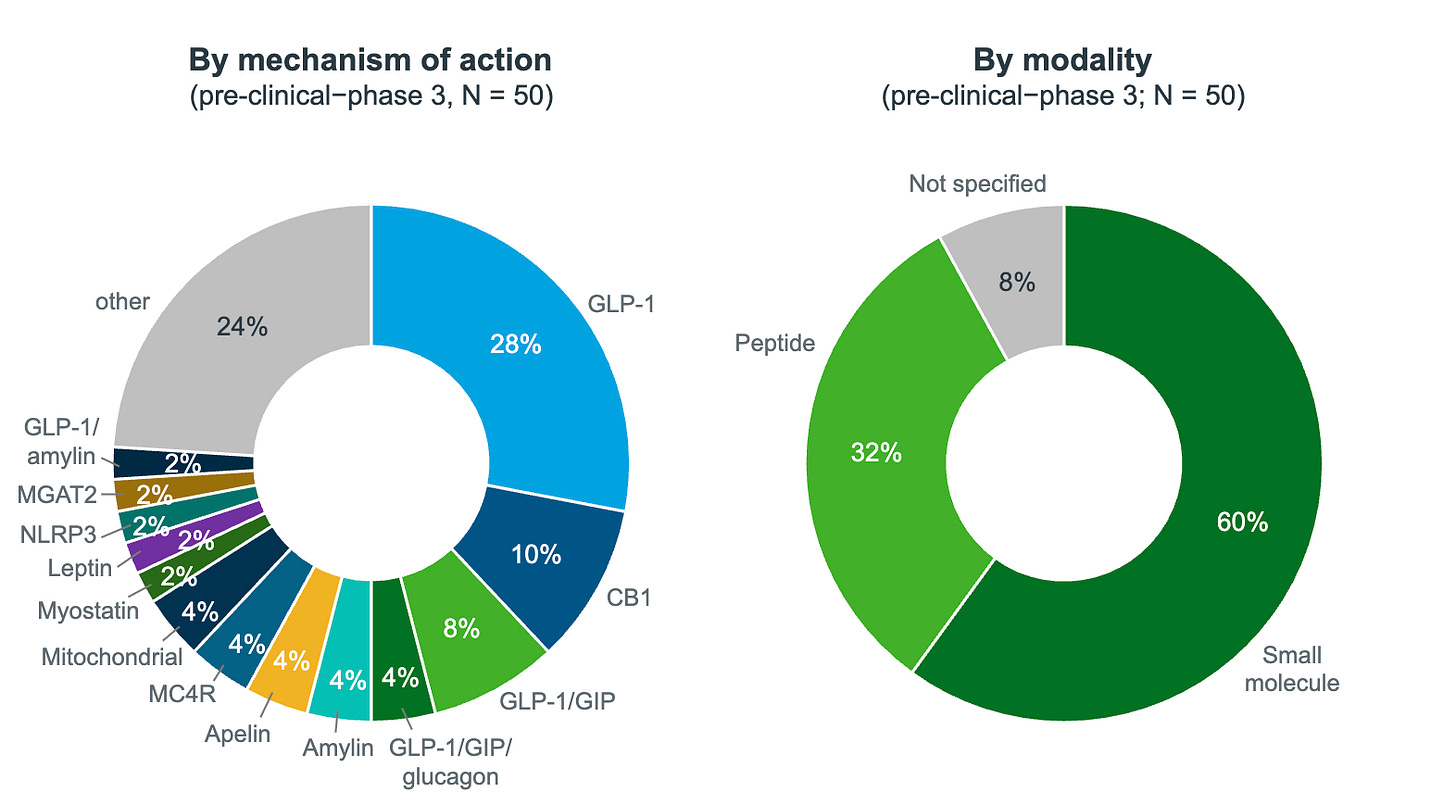

Novo Bets Big on Pills — Novo Nordisk just signed a $2.2 billion deal with Septerna to develop new oral obesity treatments. Up until now, obesity meds like semaglutide have mostly been peptide-based, meaning they're made from larger, complex molecules. That complexity makes them highly effective but also tricky and costly to manufacture. Think injections, refrigeration etc.

Novo’s new partnership with Septerna flips this model by focusing on small molecules which hit the same GLP-1 receptor, yet are easier to absorb, cost less to make, and come as daily pills, not injections. That simplicity will let Novo scale production rapidly. Fast forward one or two years, and obesity treatments are going to look completely different.

Saudi Power Move — Another strategic bet by Novo. They’re launching Wegovy in Saudi Arabia (2025) and partnering with Lifera (a biotech arm of Saudi’s sovereign wealth fund, PIF) to manufacture semaglutide API locally.

Here's why that's a big deal:

Saudi Arabia ranks third in the Arab world for obesity, with nearly 1 in 4 adults classified as obese (over 8 million people). Novo’s first-mover advantage means they can bake Wegovy deep into the region’s cultural fabric as the go-to branded med. But, Novo can’t afford to blow this opportunity. Losing ground to Lilly in the U.S. was painful enough. They will need strong local partnerships, endorsements by respected Saudi figures, and culturally resonant marketing campaigns (alongside medication guidance for Eid and Ramadan).

Strategically, the real win is turning Saudi into the heavyweight centre for API manufacturing. This insulates the kingdom from Novo's chronic supply chain bottlenecks in Europe and ensures a much steadier supply to the medical tourism hot spots of Dubai, Abu Dhabi and the rest of the UAE.

Founders, rethink your playbook. Rather than launching another online pharmacy (which I have serious doubts about in the Middle East and India—more on that soon), consider bundling GLP-1 initiation, comprehensive metabolic work-ups, and luxury recovery stays into a high-margin wellness package. Think Dubai’s booming “wellness staycation” model.

🇺🇸 Regulatory Radar

Telehealth marketing is getting tighter — Historically, FDA advertising rules focused on drug manufacturers, packers, and distributors—not telehealth providers. That technicality allowed brands like Hims&Hers to flourish in a conveniently legal grey area, but regulators seem ready to shut the door on that loophole.

The bipartisan "Protecting Patients from Deceptive Drug Ads Act" will explicitly bring digital platforms and social media influencers under direct FDA oversight, meaning clear safety profiles, side effects, and risks prominently displayed in every ad.

This means it’s time to double check compliance. The regulatory grey area won’t stay grey for much longer. I’ll update you as soon as I get more information.

Controlled substances via telehealth might be about to get (a bit) easier — A new "Special Registration" could soon allow telehealth providers to prescribe controlled substances remotely. There would be no initial in-person visit required. The registrations covers Schedule III-V meds, typically drugs with moderate-to-lower abuse risk (think anxiety meds like benzodiazepines, sleep aids such as zolpidem, testosterone, and opioid-use disorder meds like buprenorphine), plus, in limited cases, Schedule II drugs, which carry higher abuse risks (ADHD meds like Adderall, stronger opioids, stimulants).

But caution is key. While this represents a big opportunity for RESPONSIBLE telehealth players, patient safety, regulatory compliance, and careful clinical oversight must remain front and center. Under the proposed guidelines, providers would need DEA registration for each state they prescribe in, although a cheaper, streamlined “State Telemedicine Registration” (just $50 versus standard DEA fees) is being considered.

Ultimately, these clearer regulations are creating lower barriers to growth and far more predictable ways for responsible telehealth companies to scale nationwide.

🔮 Predictive Insights

Everyone’s talking about the European Congress on Obesity (ECO) — I didn't get to go to ECO this year, and I'm still a bit sad about it. But I did the next best thing—I dug through all the submitted abstracts (not exactly beach reading, I assure you) and uncovered one hidden gem you need to know about.

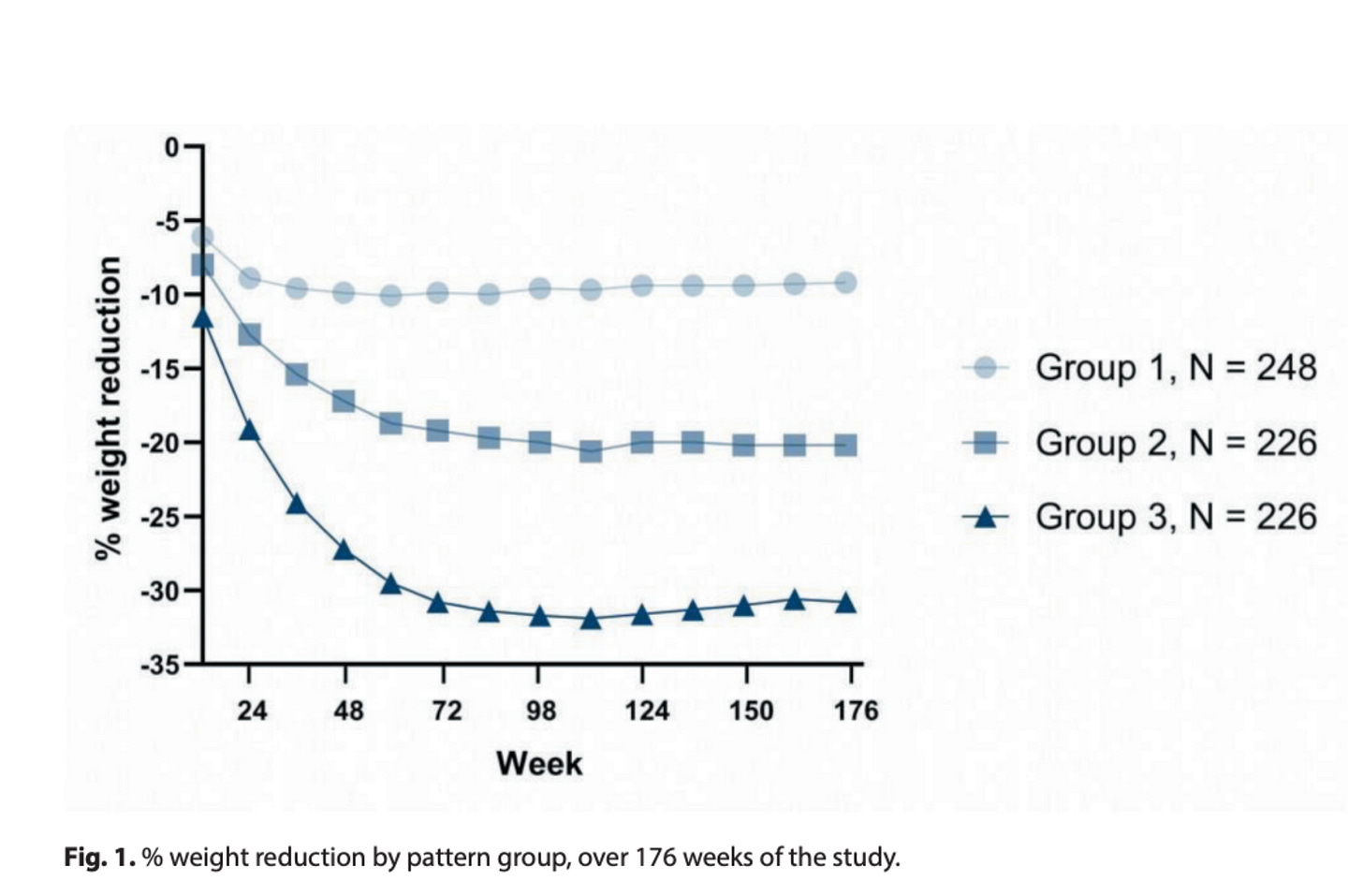

Researchers followed 700 overweight or obese adults with pre-diabetes on weekly tirzepatide for three years. That makes it the longest study into how weight-loss journeys actually unfold over time.

Here's how their trajectories broke down:

Group 1 → Slow responders (35%) lost weight slowly and plateaued around 6 months. They ended up losing about 9% of their starting weight.

Group 2 → Steady responders (32%) lost weight quicker at first, and plateaued around the 6–9 month mark. They lost about 20% of their initial weight.

Group 3→ Super responders (32%) lost weight fast and continued losing it for longer—only plateauing around the 9–12 month range—and finished with an impressive ~31% weight loss.

In simple terms, this means the speed at which someone hits the 5% weight loss milestone may predict their eventual overall weight loss and the timing of their plateau.

It’s quite a smart, low-lift, high-impact approach to patient segmentation.

Granted, this insight comes from a post-hoc abstract and not a full peer-reviewed paper. However, it’s important to start tinkering around with the huge data sets available to private providers.

As I wrote in my previous essay, prediction is the name of the game. Spot a future super-responder early and you can bolt on premium, high-margin services. Fast loss → big transformation → sticky customer.

🔎 Policy Watch

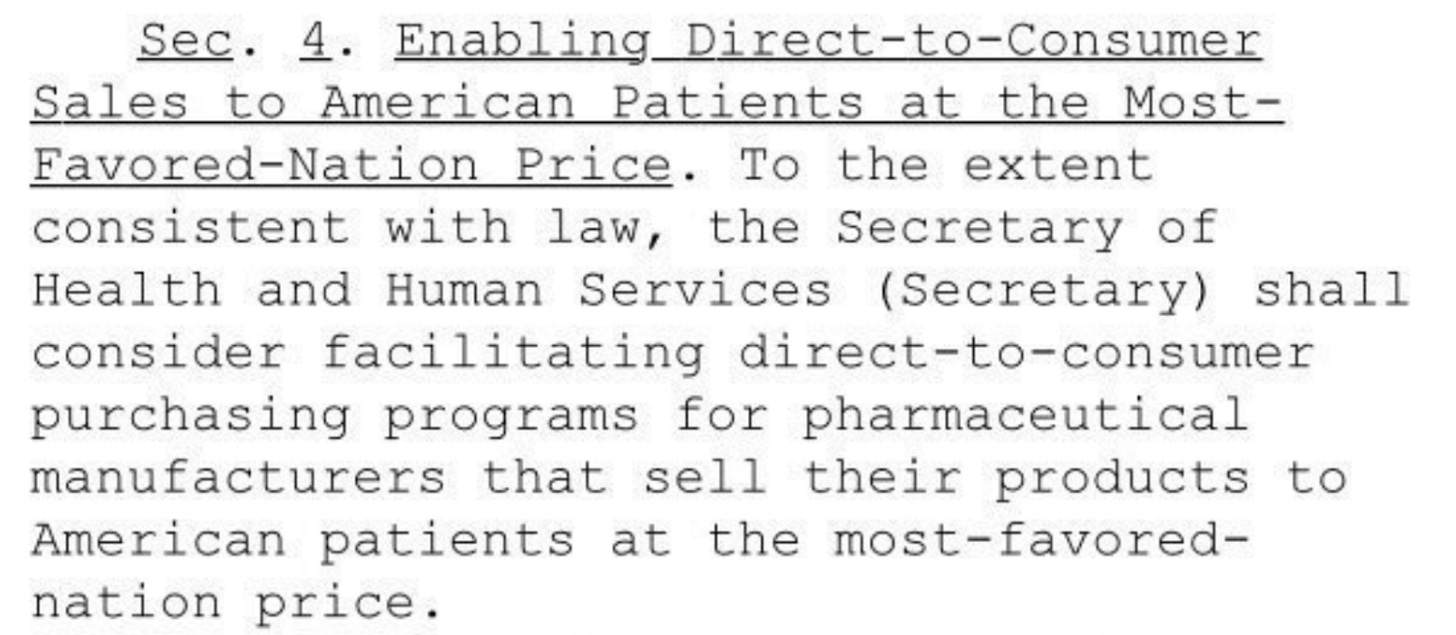

Trump’s Drug Pricing Order Could Upend GLP-1 Economics — Ahh I swear not a day goes by…Trump just signed an executive order directing U.S. officials to peg Medicare drug prices to the lowest global rates ("Most-Favored-Nation").

According to Reuters, U.S. officials have explicitly singled out GLP-1s as prime targets. In practice, it’s unclear how this plays out, since Medicare (the U.S. federal insurance program covering about 70 million Americans aged 65+ and certain disabled individuals) currently doesn’t cover Wegovy or Zepbound for obesity.

But here's where things could get explosive: Section 4 of the executive order. This hints at allowing pharma giants (think NovoCare, LillyDirect) to sell Wegovy and Zepbound directly to consumers at international benchmark prices and potentially sidestepping insurers altogether. Details remain thin and the legal hurdles are ginormous, but if this gets traction, it could radically reshape the pricing landscape.

This fits neatly into my core thesis: Pharma giants urgently need reliable distribution. You—the D2C telehealth providers—already have it.

The smartest move right now is to partner directly with pharma to create seamless, lower-cost, direct-to-consumer channels. The dots are there. Go connect them and capture the upside.