When Science Fails, and Startups Fly

Novo has cause to be disheartened, while Function Health and GLP-1 consumers in India do not

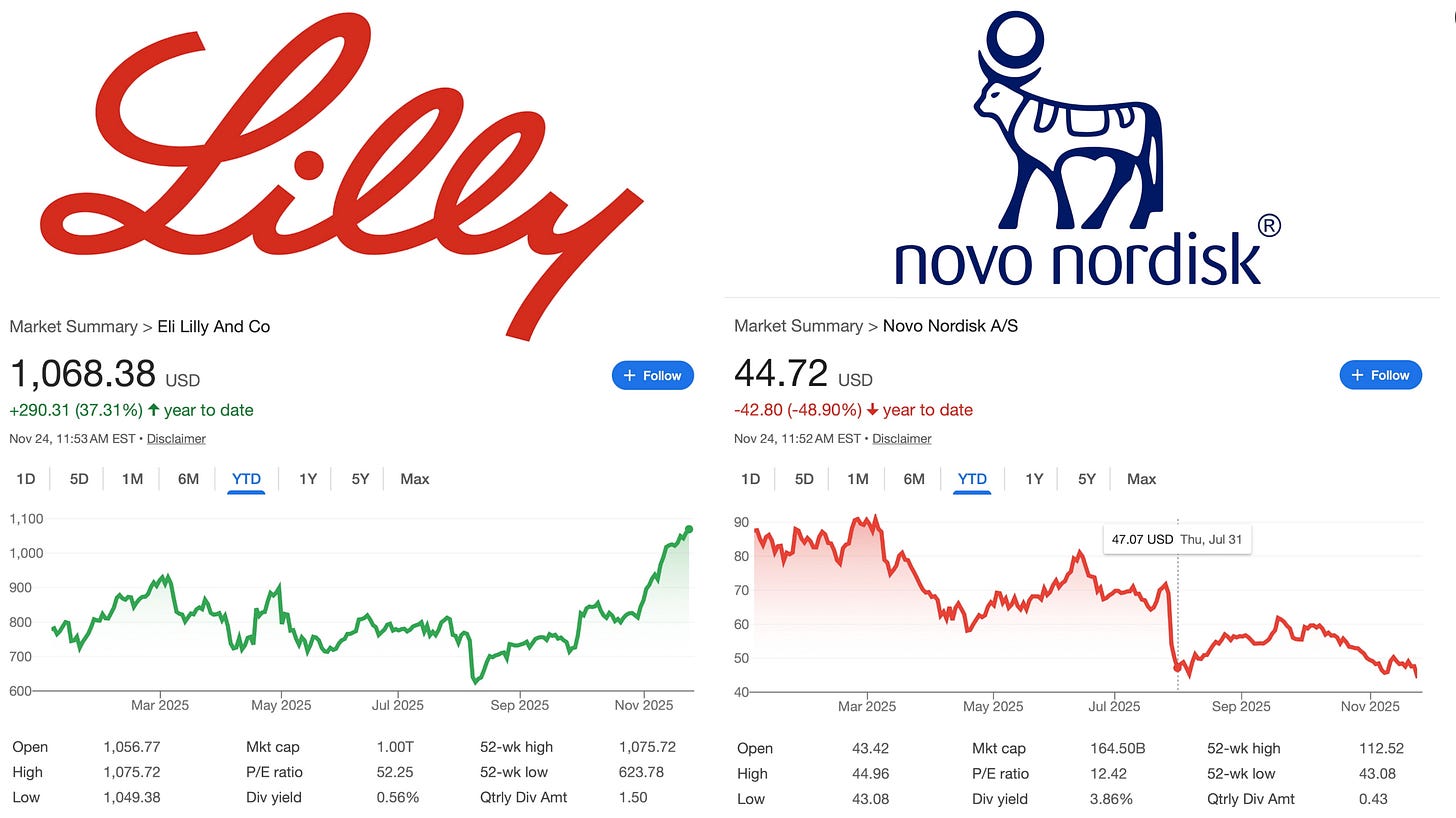

Man, Novo really can’t catch a break. EVOKE disappointed investors yesterday, and while they took a swing at Alzheimer’s disease and generated useful data for the next iteration of trials, the market doesn’t hand out participation trophies. The stock dropped 12%, reflecting an ongoing bearish sentiment toward the Danish giant.

Meanwhile, Function Health raised $298 million at a $2.5 billion valuation. A big cause of celebration for the company, but, looking closer, the unit economics don’t seem to add up.

And in March, India is about to run the most important GLP-1 experiment that’s ever been conducted.

Let’s get into it.

But first…this edition is proudly brought to you by Light-it.

If you’re building a GLP-1 or weight-management startup, I’m about to save you six months of pain.

Most dev shops will nod along when you explain telehealth workflows, then come back three weeks later with a patient portal that violates HIPAA in five different ways. Or they’ll build your prescription routing system without understanding why pharmacy integrations aren’t just API calls.

I’ve watched and heard this happen enough times that when someone asks me for a dev shop recommendation in this space, there’s only one name I give them: Light-it.

They know the GLP-1 D2C space intimately- from onboarding flows and async visits to prescription routing, insurance checks, and refill reminders – they’ve helped multiple D2C telehealth companies ship products that work at scale, from MVP to series B and beyond.

The result?

You skip the expensive learning curve and start shipping products that actually work in clinical settings from day one.

Building in health tech?

EVOKE disappoints. When I was in medical school, a vascular surgeon gave a lecture about research that is still etched into my brain. He told us not to be disappointed when results don’t go our way because research is where you make cold, hard contact with reality. And in the long trail of science, a negative result is as important as a positive one.

Who knew surgeons gave such good life advice! I thought of him when I read Novo’s press release announcing that the EVOKE and EVOKE+ trials failed to show that oral semaglutide slows Alzheimer’s disease progression.

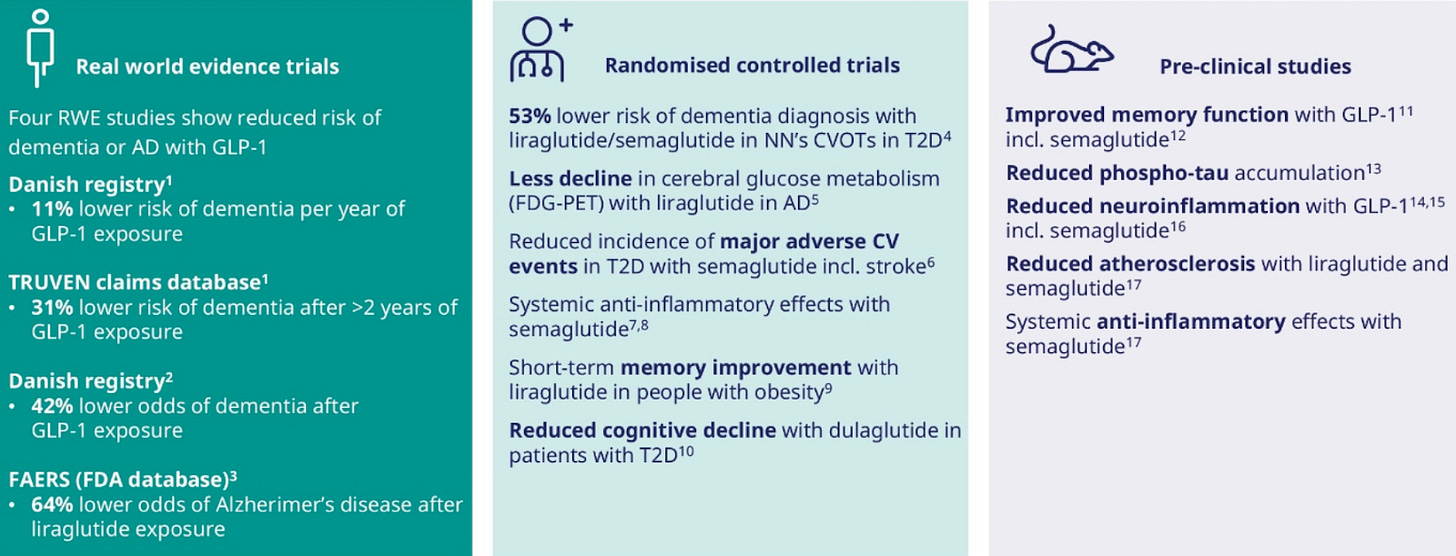

It’s a bummer because real-world studies showed promise, and last year, a Phase 2 trial signaled that liraglutide patients had nearly 50% less brain shrinkage in regions controlling memory and learning, so the pieces seemed to fit.

Maybe GLP-1s are highly effective at primary prevention, and patients with cognitive symptoms are too far down the disease pathway for things to mend.

We don’t know.

Nonetheless, the results are clear (phase 3 RCT trumps all), and I got this prediction wrong, so I’m eating a generous portion of humble pie.

GLP-1s are remarkable drugs that have transformed diabetes and obesity management. But it looks like they’re not the everything drug. If it’s any consolation to those of you with family or friends affected by this terrible condition, understand that while these failures are painful data points, they are still very useful data points that will pave the way for future trials.

Unfortunately, this means Novo ends Q4 bruised and slightly battered. After an initial plunge of more than 12% on the EVOKE readout, the shares are now down roughly 50% year‑to‑date and on track for their worst year in decades.

In my view, a double-digit drop for a rigorous clinical trial in a notoriously difficult disease area feels like an overreaction.

But markets prize narrative above all else, and Novo’s narrative right now is that it’s stumbling from one setback to another.

How will Novo start the new year?

They’ve got the Wegovy in a pill launch (oral sema 25mg), which now has to be a blockbuster, and, as I wrote a few months ago, they’ll be relying on performance marketing from the D2C telehealth companies they’ve partnered with to make sure that everyone and their mother knows about tablet Wegovy after the holidays.

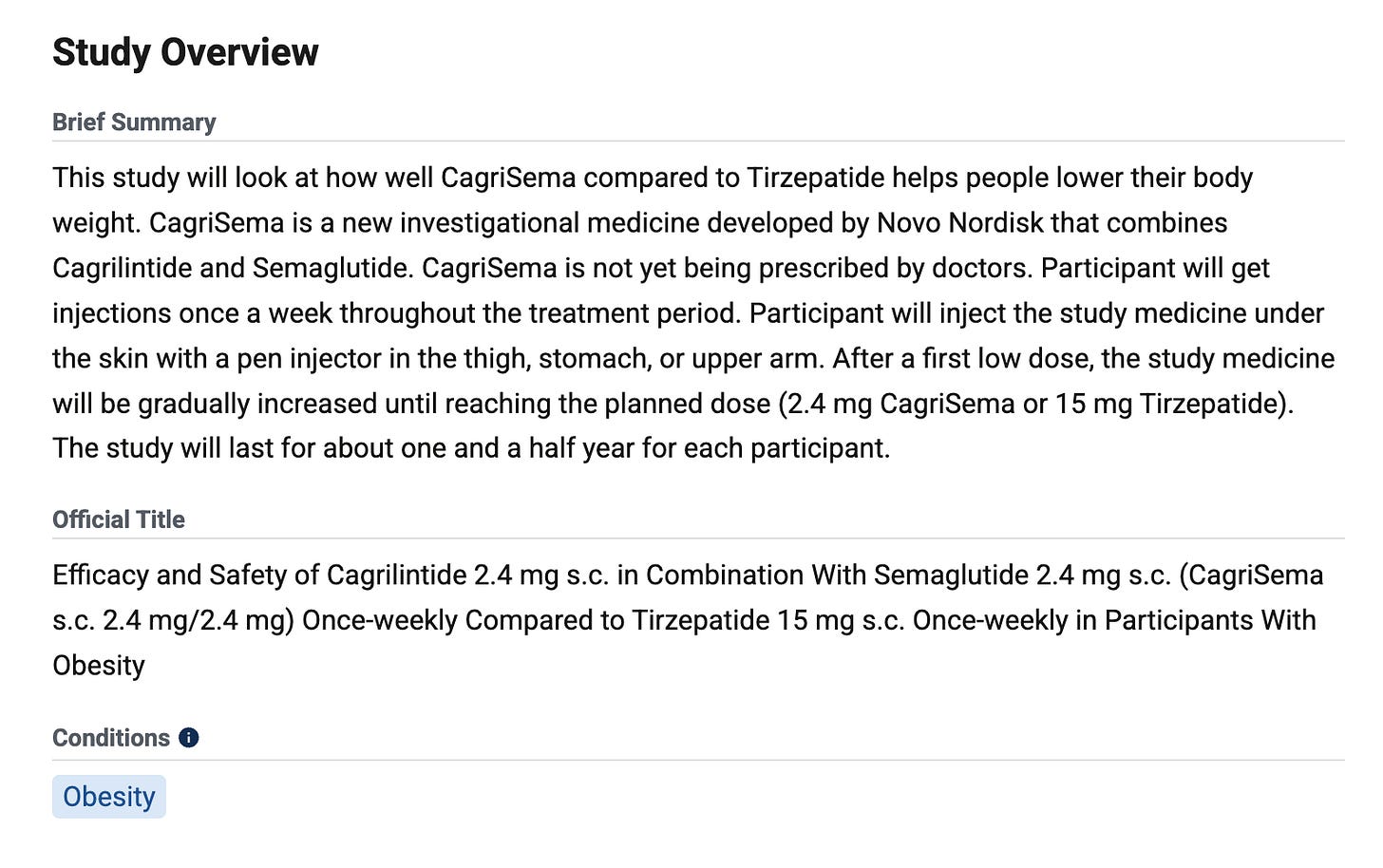

They also have a head-to-head study comparing the new CagriSema against tirzepatide, with readouts expected in January. If CagriSema disappoints, expect the stock to take a nosedive.

We’re a month away from Christmas, so let’s hope someone in Copenhagen is drafting a very specific letter to the North Pole.

Function Health’s $2.5B valuation doesn’t add up. Function Health raised $298M at a $2.5B valuation. I’d love to talk to the investors and figure out what quantities of psychedelics they’re microdosing. In all seriousness, let’s take a look at unit economics.

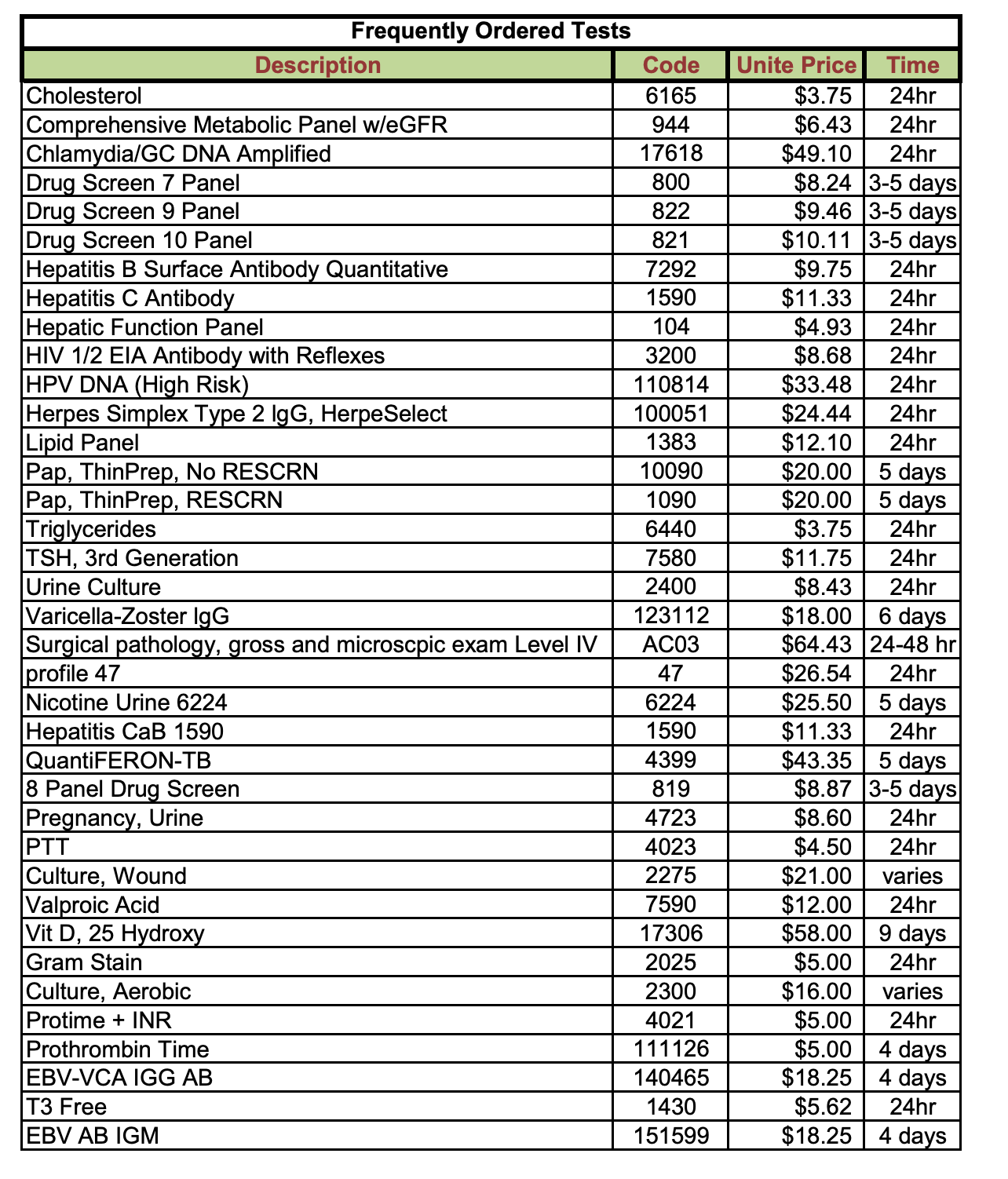

We know each member pays $499 per year for two major lab visits (one every 6 months), which covers around 100+ biomarkers.

Quest Diagnostics is processing these labs, and with 200,000 members, Function is getting volume discounts. Given the quantities of biomarkers being ordered, I estimate Quest fees run around $250 per member per year.

Then factor in clinician time to review results and generate action plans — call it 30 minutes of physician or NP time and include platform and support costs.

Rough COGS: $370

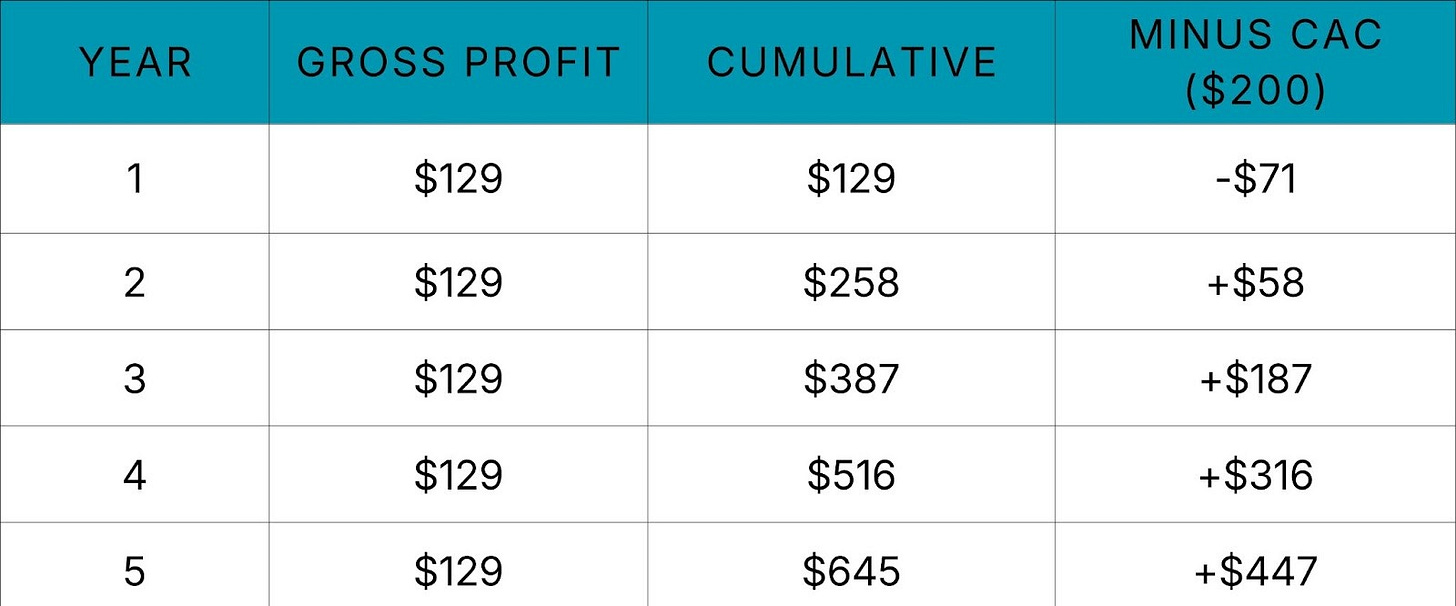

This leaves $129 in gross profit per member and a 26% gross margin.

Now you have to add in customer acquisition. Function is running a mix of different content strategies, including paid marketing, influencer relationships, and referrals. DTC health brands typically spend $150 to $300 to acquire a customer in this space, so let’s assume $200.

The question now is: How long does it take to earn that $200 back? By my calculations, it’s roughly 1.5 years (CAC ÷ gross profit).

For a DTC subscription business, a payback period that long is uncomfortable. Investors usually want their money back in under twelve months, and anything pushing past eighteen months only works if retention is spectacular.

In Function’s case, it means the average member has to stick around for well over a year and a half just for the company to break even on the acquisition cost.

And with these unit economics, the classic “3× LTV/CAC” rule of thumb would require people to stay for almost five years on average!

That feels insanely optimistic.

For some context, about three months ago, I did blood tests that included liver function, full blood count, testosterone, etc., etc. Everything came back normal except mildly elevated bilirubin, which I already knew about because I have Gilbert’s syndrome (it’s benign).

I fed the data into ChatGPT, and nothing really moved my insight needle. If I were in the US, would I pay $499 to do it again next year? No.

Considering that I’m exactly the type of customer Function is targeting (health-conscious, willing to spend, etc.), prevention only works as a business when there’s something to prevent. When your results come back normal, you need another solid offering to hook people in; otherwise, the novelty wears off quickly, and people will churn after one cycle.

This reflects what we’ve seen with Randox and Thriva in the UK. Ultimately, in my view, the poor unit economics of this type of service happen because Labs are a funnel and not a business.

D2C telehealth players like Hims, Remedy Meds, and Noom are much better positioned to capitalize on blood testing because you can get a compounded/personalised medication tailored to your needs that you can’t get anywhere else.

This is much more compelling and makes customers stickier. Even if results are “normal,” there’s always something to up-sell or x-sell when you control the pharmacy.

Then there is the fact that Hims just launched the same offering with Quest at cheaper pricing: $199 for 50 biomarkers, $499 for 120, and on top of that, you have Oura and Superpower and Whoop all competing for the same customers — CAC is going to increase, and unit economics are going to get much tougher.

Overall, I’m bearish, and I wouldn’t be surprised if we see acquisitions in this space over the next 12-18 months.

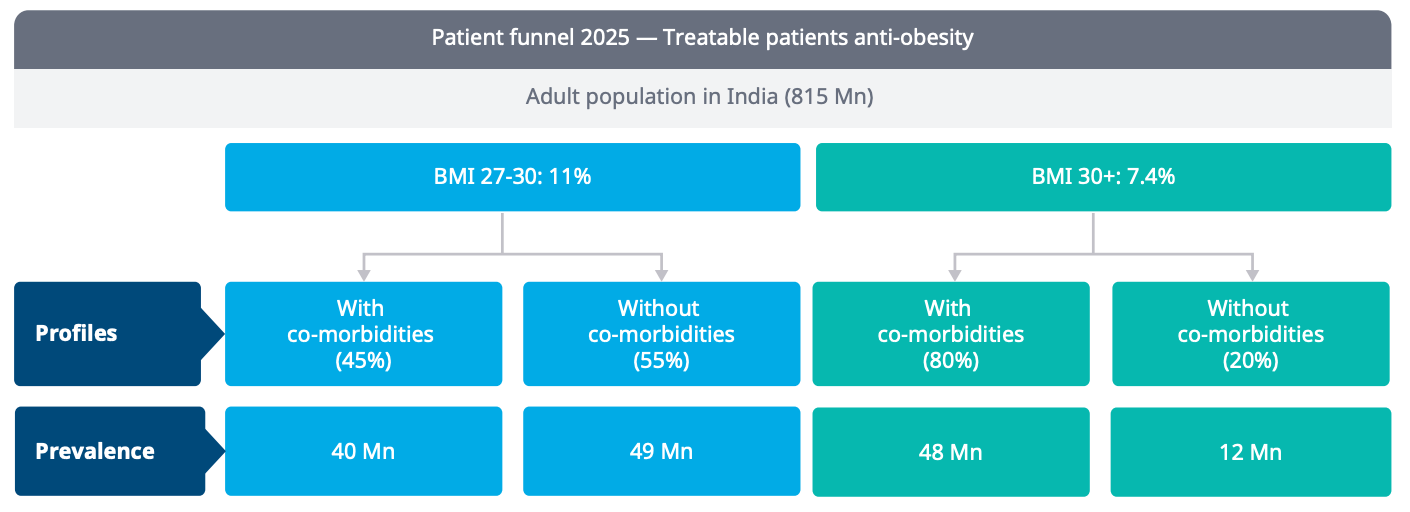

The Indian GLP-1 Experiment. In March, India will become one of the first major markets where semaglutide will lose patent protection. Generic copies will flood the market, and prices are estimated to tank by 80-90%!

Considering India has nearly 150 million people living with overweight or obesity, the population will suddenly have access to one of the most effective weight-loss drugs ever made at affordable prices.

So what happens next? When someone can walk to their corner pharmacy and buy generic semaglutide for a few dollars, do they stick with it? What does retention look like without the sunk-cost psychology of a $100 monthly prescription? And over five to ten years, what happens to cardiac events, diabetes rates, and mortality?

I’ll be watching this closely and doing a deeper dive on it very soon (I’m in the process of writing the essay). In the meantime, one statistic that really caught my attention was that over half of obese adults in India fall in the top two income quintiles.

It’s safe to assume, therefore, that these are very digitally savvy consumers.

Does this mean e-pharmacies like 1mg, pharmeasy and NetMeds will flourish?

We’ll soon find out.

**The views, opinions, and recommendations expressed in this essay are solely my own and do not represent the views, policies, or positions of my employer or any other organization with which I am affiliated. This content is provided for informational purposes only and should not be considered medical, legal or investment advice.**