Who Wins (and Loses) in Pharma’s Latest GLP-1 Power Play?

Novo's surprising partnerships, disruptive NHS whispers, and a fresh shift in employer economics could redefine the D2C landscape.

Hello and happy Sunday!

I’m currently in Lisbon, enjoying a pastel de nata (or ten) and successfully annoying my girlfriend, who’s involuntarily learned more about GLP-1s this weekend than she ever cared to know.

But seriously, this week had it all. Big Pharma partnership twists, game-changing weight-loss numbers, stubborn insurance gaps and some juicy employer-driven economics. Fair warning. This week's digest is longer than usual, because the news just wouldn't stop. Buckle up, it's worth your time.

Here's what every founder, operator, and investor needs to know to avoid getting blindsided by pharma’s latest moves.

🇬🇧 Could OTC GLP-1 injections threaten D2C telehealth in the UK? - According to recent, albeit speculative reports from the Daily Mail, weight-loss injections like Wegovy and Mounjaro could soon be available through over the counter consultations at pharmacies in the UK for just £9.90. If true, this would undercut the current private-market price tag of roughly £150 a month and completely disrupt (make extinct) D2C telehealth models built around GLP-1 prescriptions.

But before panic sets in, let’s hit pause. These reports are tagged as "speculative," and given the NHS’s notoriously sluggish and patchy rollout of obesity care—remember, Wegovy currently has a two-year NHS waiting list—this scenario feels extremely ambitious to say the least.

Operationally and financially, can the NHS realistically fund and manage such a massive scale-up? No, probably not.

Still, these signals matter (even if it was reported in the Daily Mail). If you’re running a UK-based telehealth operation reliant on GLP-1, now’s the moment to seriously think about putting your ducks in a row by diversifying your product portfolio beyond weight-loss injections and launching in different markets to spread the risk.

⚖️ Novo chooses partnerships over courtrooms - I was convinced that Novo Nordisk was gearing up to hit telehealth giants Hims & Hers, Ro, and LifeMD with lawsuits for pushing compounded semaglutide. Nope. I was wrong. Instead, all three telehealth players have partnered directly with NovoCare Pharmacy, offering authentic FDA-approved Wegovy for just $499 per month (down from the usual wallet-crushing list price of $1,349).

This means:

Compounded semaglutide is wiped out. Fineto. D2C telehealth providers aren't risking Novo or Lilly's wrath anytime soon.

Novo gains massive new distribution channels overnight. Even better, Novo captures mountains of real-world data in D2C partnerships. Pure gold for understanding side-effects, adherence, and spotting lucrative new indications for Wegovy.

Ro just hit the telehealth jackpot by becoming the only U.S. telehealth provider plugged directly into both NovoCare (Wegovy) and Lilly Direct (Zepbound/Mounjaro). These partnerships mean guaranteed drug supply, better pricing, and major brand credibility. All massive advantages in attracting and locking in patients.

The next big battleground in telehealth will be owning direct distribution channels with Pharma. If you're a founder or operator looking to scale strategically, now is the time to build meaningful relationships or exclusive distribution agreements.

🔥CVS picks Novo’s Wegovy- Novo Nordisk scored another major victory this week as CVS Caremark, the largest pharmacy benefit manager (PBM) in the US, announced that Wegovy will become the preferred GLP-1 medication on its largest commercial formularies starting July 1, 2025. CVS manages prescription coverage for millions of Americans via employer-sponsored health plans, making this a huge strategic win for Novo.

With preferred formulary status, Wegovy instantly becomes cheaper and more accessible to millions of patients. Meanwhile, Eli Lilly’s Zepbound is now sidelined, losing preferred coverage status—meaning workplaces that want to stick with Zepbound will face higher costs. This sets the stage for a potential pricing battle and a huge challenge for Lilly’s market share and revenue forecasts.

🥊 Novo Lands Another Big Punch on Lilly with Once-Daily Oral Wegovy - I know, I know—Novo has completely dominated this week’s digest. But they keep making headline grabbing moves. Just two days ago they announced that the FDA officially accepted its submission for a once-daily, oral version of Wegovy (semaglutide). Approval could come as soon as Q4 2025, marking the first-ever oral GLP-1 specifically for obesity and cardiovascular risk reduction and giving Novo first mover advantage in the oral GLP-1 space. Of course, the news sent share prices up, up, up.

However, many industry insiders have been wondering why Novo opted for the 25 mg dose despite the slightly higher weight loss seen with 50 mg in the earlier OASIS 1 trial. This is because 25 mg delivered similar weight-loss efficacy to the 50mg dose but with better patient tolerability. In the 64-week OASIS 4 trial, the 25 mg dose achieved an impressive 13.6% weight loss (vs. 2.2% with placebo), striking the ideal balance between effectiveness, adherence, and patient comfort.

Founders, the takeaway here is you need to start prepping for an oral-first GLP-1 market right now.

👑 Lilly’s not retreating (but Novo landed some serious punches) - Despite a stellar Q1 2025 earnings report, Lilly spent most of its investor call fielding questions from analysts anxious about how they'll respond to Novo’s recent flurry of strategic moves. Still, Lilly’s numbers this quarter were impressive—here’s what stood out:

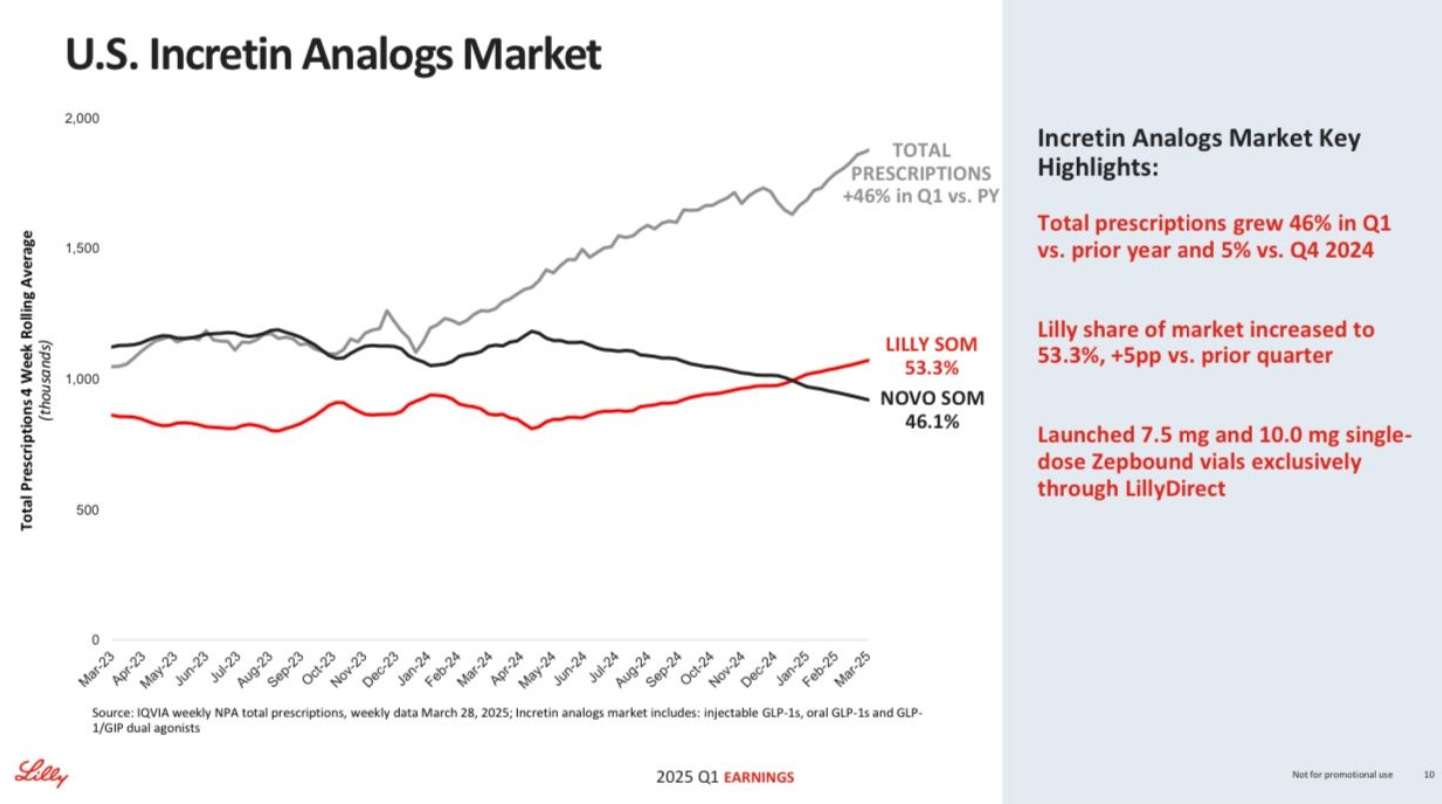

I predicted Lilly would soon knock Novo off its GLP-1 throne, and—right on cue—they've done it. Lilly now holds a commanding 53.3% of the U.S. GLP-1 market, overtaking Novo’s 46.1% for the first time ever because of booming demand for Zepbound and Mounjaro. With GLP-1 prescriptions surging 46% year-over-year, we're witnessing a once-in-a-generation shift in medicine. And if Lilly continues on it’s trajectory (and manages to out manoeuvre Novo) they’ll be the ones who write the GLP-1 narrative.

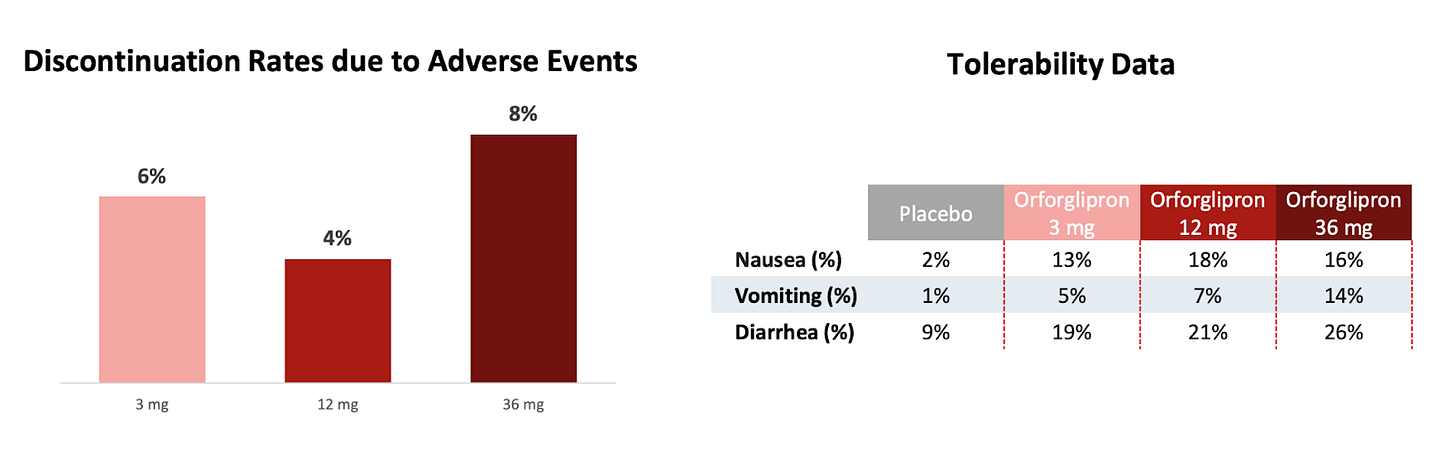

Lilly’s ambitions for Orforglipron, its once-daily oral GLP-1 medication, go way beyond diabetes and obesity. They're kicking off expansive global trials in hypertension and obstructive sleep apnea (OSA), slated to finish between 2025 and 2027. With safety data already looking reassuringly similar to established GLP-1 meds, the commercial upside could be massive. If you're tracking pharma stocks, Lilly’s pipeline just got even more compelling.

If you thought Zepbound (tirzepatide) was impressive, wait till you see retatrutide. Lilly’s triple-agonist (GLP-1, GIP, and glucagon receptors all in one drug) is set to redefine what's possible for weight loss. With significantly greater effectiveness than Zepbound (24.2% in 48 weeks), retatrutide is barreling through Phase 3 trials for obesity and osteoarthritis (OA) knee pain. This is a major indication that could open huge markets beyond traditional obesity management.

Lilly expects regulatory submissions from these trials by 2026, with a potential approval and market launch by 2027.

🎢 America’s huge GLP-1 gap - A new nationwide analysis of over 39 million Americans highlights how badly GLP-1 prescribing trails actual demand. Despite clear eligibility, only 2.3% of adults received prescriptions for semaglutide or tirzepatide indicated for obesity. The adoption of this new medication has been really, really slow in clinical practice. Now, could one of the problems be physician bias? Possibly.

But the main culprit here is limited insurance coverage. Employers and insurers know that widespread GLP-1 adoption at current prices could devastate their bottom lines unless there's clear evidence of financial ROI. Until payers find a sustainable solution, most patients will keep footing the bill themselves. Or simply go without.

If employers were to step in and offer comprehensive GLP-1 insurance coverage, how might that affect the current landscape?

☘️ Aon’s GLP-1 playbook just gave telehealth its next big growth channel - the global health analytics giant just dropped a huge study analyzing 139,000 U.S.-based workers with employer health coverage who took GLP-1 medications between 2022 and 2024. The results might finally give insurers the ROI evidence they need:

After two years on GLP-1 treatments, patients’ healthcare spending growth was just 7%—half the rate (14%) of comparable patients with obesity and chronic conditions who weren't taking these drugs.

Patients on GLP-1 medications experienced 44% fewer hospitalizations for heart attacks, strokes, and other serious cardiovascular issues. They also saw notable reductions in costly health conditions like pneumonia, osteoporosis, and substance-use disorders.

Employees taking GLP-1s missed fewer workdays, had lower disability rates, and showed better overall performance (full data to be released in May).

With these findings, Aon put skin in the game. They’ve rolled out their own comprehensive GLP-1 benefit for their employees, partnering with eMed to provide subsidized:

At-home blood tests and biometric tracking using AI

Weekly virtual check-ins and 24/7 side-effect management

Holistic, stigma-free support

For telehealth companies, this is a golden, right-now opportunity. Employers want obesity solutions that deliver clear ROI and healthier workforces. Any telehealth provider who can rapidly build affordable, end-to-end GLP-1 programs—mirroring Aon’s model—stands to dominate a rapidly growing employer-focused market.