Why Novo Nordisk and Eli Lilly Won't Compete on Price

But they will compete on market access and launch success

When Novo prices oral semaglutide in the next few months, they'll be anchoring expectations for a $25 billion market. Will the price of the oral GLP-1 match the price of the injectables, or will it be discounted — and by how much?

With the orforglipron data in hand now, pricing is easier to predict, as are Novo’s and Lilly’s strategic positions: both can win without undercutting each other.

The more interesting question is what Novo does with its 8-month head start.

Unlike Wegovy's launch back in 2021, Novo now has an army of cash-pay and D2C channels locked, loaded, and ready to mobilize.

If they can drive a meaningful % through these channels while securing preferential formulary positions to keep co-pays low and fend off compounders, they'll create a blockbuster launch that Lilly will struggle to match.

Two drugs, two markets

There are approximately 56 million American adults with class 1 obesity (BMI 30-34.9) who need roughly 10-15% weight loss to reach a healthy BMI. This is something orals can now effectively deliver.

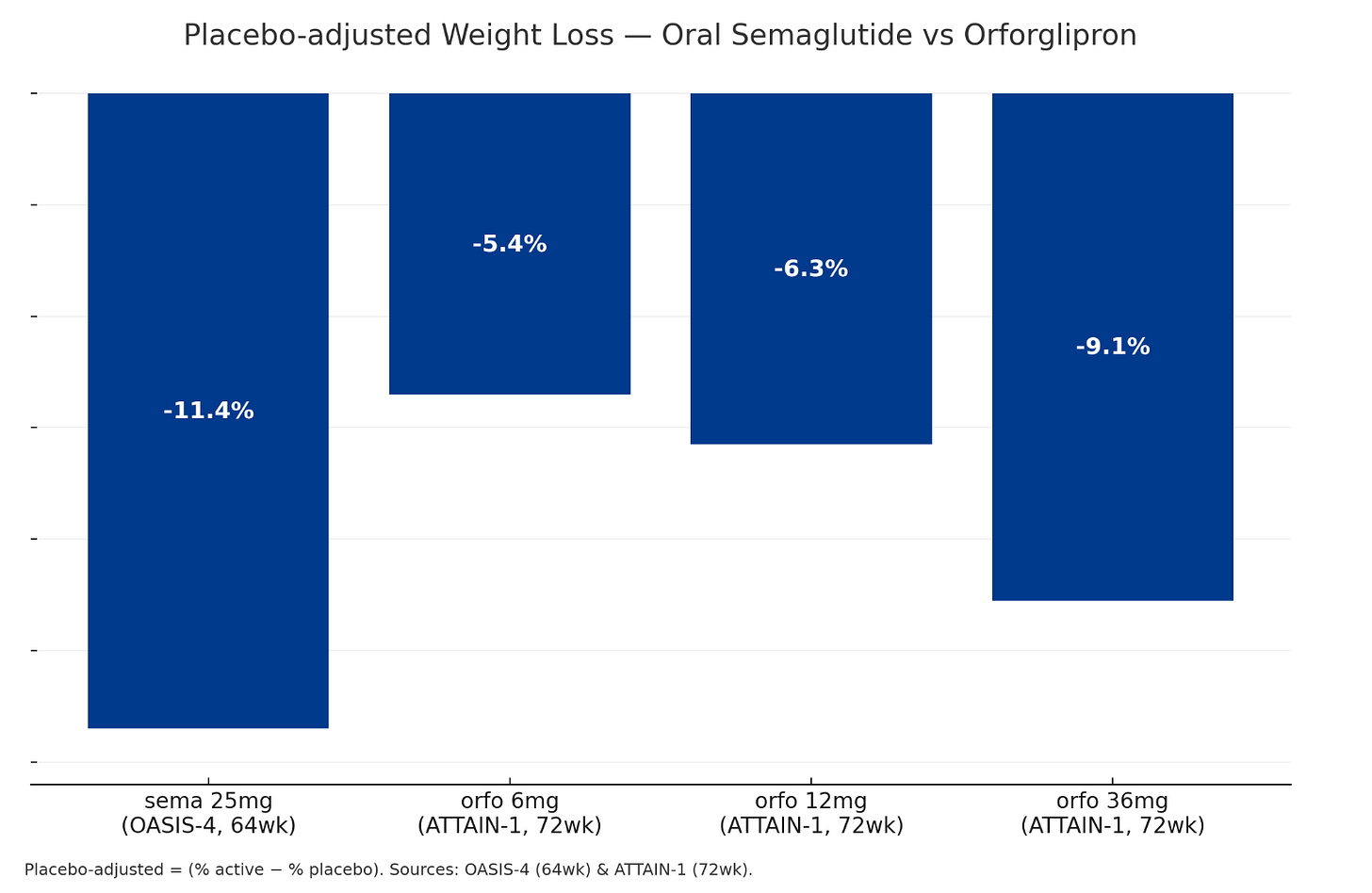

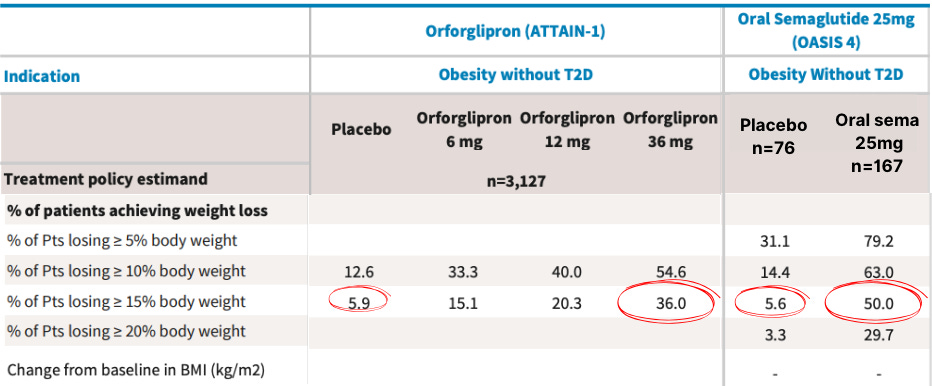

Based on OASIS-4 versus ATTAIN-1 trials, oral sema 25mg leads to higher average weight loss (11.4% vs 9.1%) in a shorter timeframe (64 weeks vs 72 weeks).

A few percentage points might not matter clinically, but they become powerful marketing tools when you're telling patients they have a 44% chance of hitting their target weight with oral sema versus 30%-ish with orforglipron—with similar side effects for both.

Add in Novo's 8-month head start to embed 'Wegovy in a pill' into the cultural narrative, and oral sema should dominate the obesity-only market.

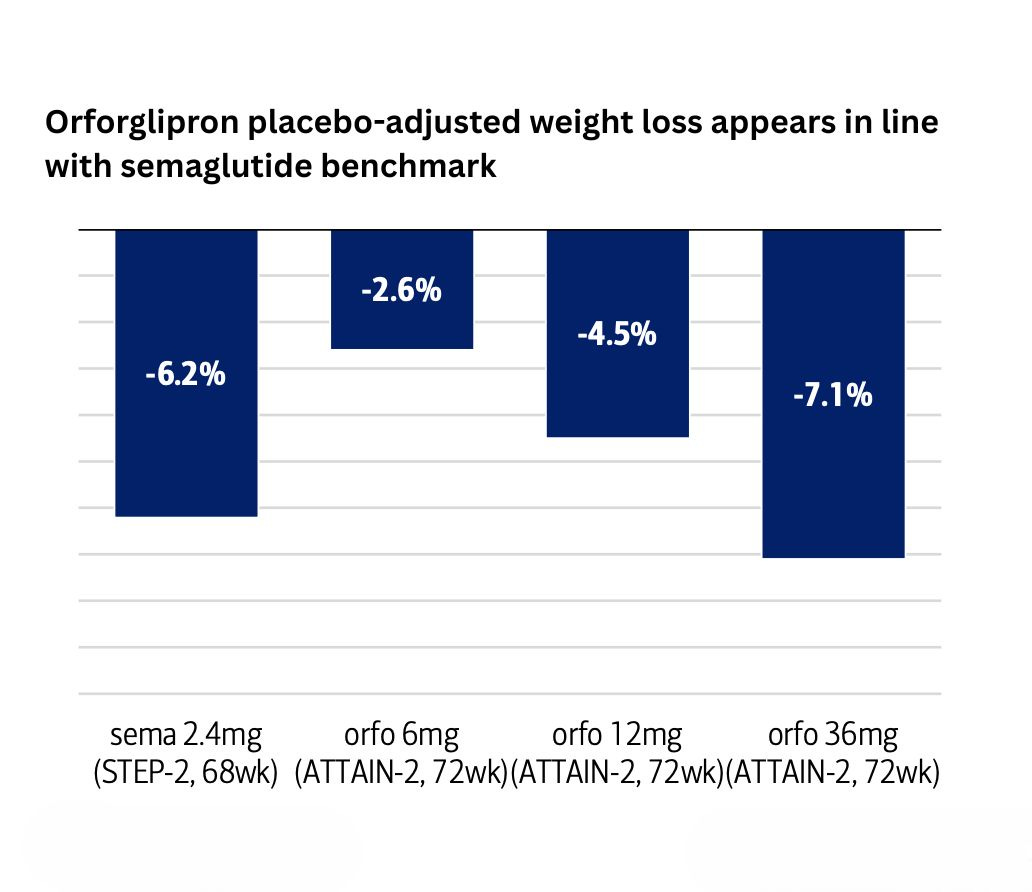

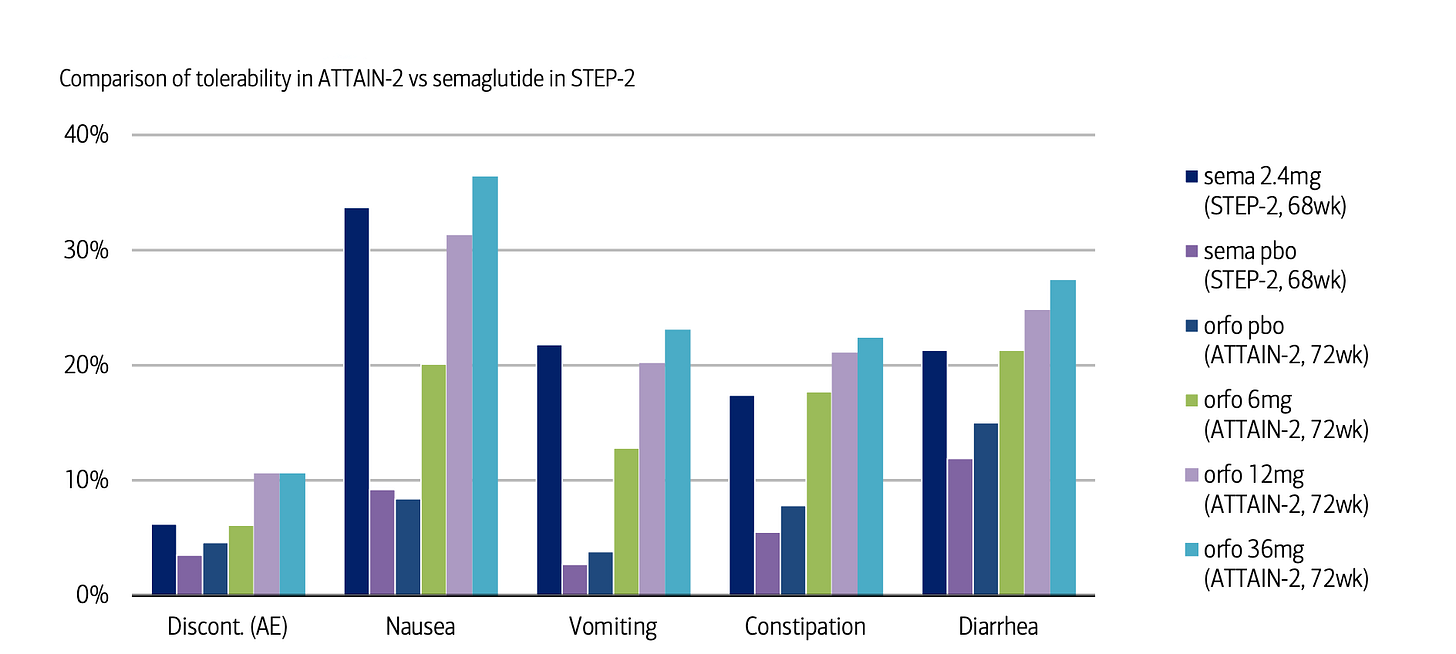

But…when you look at the ATTAIN-2 data in diabetic patients with obesity — notoriously the hardest population to treat — orforglipron produces better results, delivering 7.1% placebo-adjusted weight loss compared to injectable Wegovy's 6.2%.

I'm surprised this wasn't headline news, given this is the first time in history an oral small molecule has outperformed an injectable peptide!

Because diabetic patients also typically have multiple conditions like high blood pressure, high cholesterol, etc., they’re likely juggling multiple medications, too.

The last thing they need is another complex regimen like oral sema where they have to fast for 30 minutes every morning before they can take another medication.

It’ll just become a huge pain for them, and adherence will be shot to the ground.

In contrast, orforglipron fits right into their existing routine. They can take it at any time of the day, fasted or not, with a tolerability profile similar to injectable GLP-1s. Given that roughly 89% of Type 2 diabetics are also overweight/obese in the US, that's a massive market where orforglipron has both clinical and practical superiority.

This is why I believe Lilly will own this segment.

Why there won't be a price war

So oral sema wins for obesity-only patients, while orforglipron is better for diabetic patients.

Of course, real-world prescribing is messier than clinical trials suggest. Some diabetics will get oral sema, some obesity-only patients will try orforglipron. But when the dust settles, the data shows where each drug performs best — and that's where I believe the market share will concentrate.

This natural segmentation should convince you that huge pricing discounts aren't happening. Both drugs are well differentiated with unique value propositions and significant label expansion opportunities.

In particular, oral sema will likely launch with CV benefits and MASH indications already on the label. More importantly, if the 3mg, 7mg, or 14mg doses show Alzheimer's protection through the evoke trial (read out in September), oral sema will transform from a weight-loss/diabetes treatment into one of the most impressive drugs of the decade.

The companies' recent actions confirm they're thinking this way as well. Lilly's 170% UK price hike for Mounjaro — clearly aimed at US pricing optics — isn't the behavior of a company planning to compete on cost.

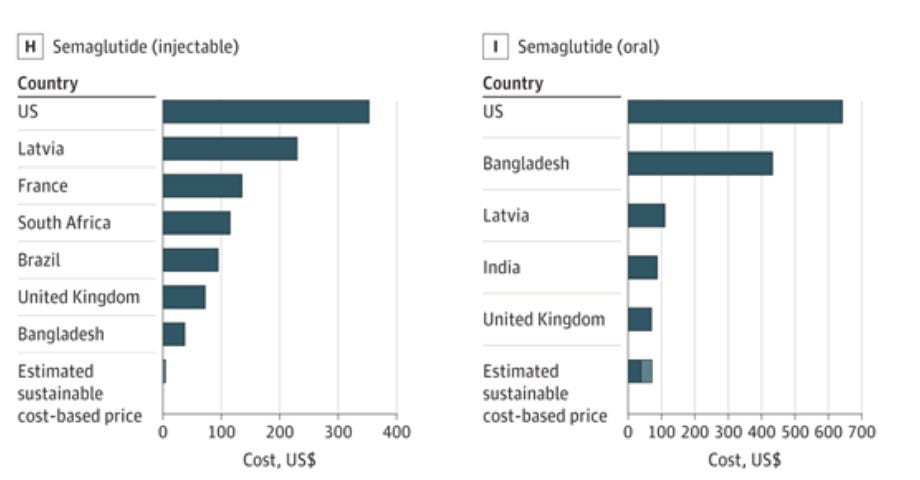

Meanwhile, the COGS for oral sema are actually higher than for Wegovy: each daily 25mg tablet means patients consume 175mg of API per week versus just 2.4mg for weekly Wegovy, that's roughly 73x more active ingredient per patient. Additionally, each tablet needs SNAC (an absorption enhancer) coating to increase the drug's bioavailability.

I think these added requirements more than offset any savings from removing the pen.

Given this reality, I expect both drugs to list around $1,100/month (WAC), within 20% of Ozempic ($998) and Wegovy ($1,349).

Cash-pay pricing will be similarly rational.

With Wegovy at $499 through NovoCare, oral sema will likely land at $400-450, in line with the 'Wegovy in a pill' market positioning rather than becoming a discount alternative. Even at these prices, Novo probably makes more per prescription than they do through PBMs after rebates.

So if both companies will price similarly, what determines who wins? Very simply, commercial execution.

And Novo's about to demonstrate what modern drug launches will look like.

The multi-channel revolution

This is the first time in pharma history that a drug launches with D2C and telehealth as primary channels.

Ro, LifeMD, WeightWatchers, and GoodRx already process thousands of GLP-1 scripts monthly through NovoCare, essentially giving them a pre-built salesforce.

They have also spent the better part of two years building databases of weight-loss seekers and perfecting conversion funnels with millions in daily ad spend. Now, Novo will benefit from this ecosystem at no extra charge.

The 8-month window gives Novo time to convert these databases into actual patients before orforglipron launches, so expect your Instagram feed to basically be 'Wegovy in a pill' ads.

These partnerships are now delivering on scale.

Novo's earnings call confirmed that Wegovy captured 10% of total prescriptions through its pharmacy platform — roughly 28,000 scripts per week at ~$499 each. That's $14 million in weekly revenue outside the insurance system entirely.

And that's for an injectable.

With oral sema removing the needle barrier, these numbers could multiply, and by the time Lilly mobilizes their own D2C channels, patients will already be stable on sema and we know that switching stable patients is very difficult.

Of course, while cash-pay provides immediate revenue, the real juicy volume still comes through insurance. And Novo will have an interesting strategy to lock that down as well.

Boxing out the competition

CVS's July 1st formulary switch from Zepbound to Wegovy delivered what UBS called a 'step change' in total prescription volume, helping Wegovy maintain 40%+ market share for over five consecutive weeks.

Now, Novo will push for the same exclusive positioning for oral sema across all the big three PBMs, using the same deeper rebates that worked for Wegovy.

Shivu Sharma, a biotech specialist, calls this 'boxing out' - once you've secured exclusive formulary positions, competitors face an almost impossible climb to dislodge you. It's aggressive but effective.

Another reason Novo will offer deeper rebates is to fend off compounders. Given that the FDA shows no signs of acting, a smart way to kill the compounding threat (apart from patent litigation) is to make copays so low — in the region of $25-50 — that it makes buying from 503a pharmacies illogical.

However, an issue Novo will have to navigate is people being prescribed oral sema but not accessing it due to prior authorization barriers.

They'll have to ease this friction as much as possible so people who get prescribed actually fill their scripts. One way they can do this is by embedding NovoCare navigators directly into prescriber workflows, especially at telehealth partners, to handle prior authorizations in real-time before patients leave their virtual visit.

What this really means

So where does this leave us? Novo will price oral sema within 20% of injectables, and Lilly will match. Both will make billions, and the only surprise here is that everyone's surprised!

If Novo drives meaningful volume through cash-pay and telehealth channels — say 30-40% of scripts — they'll prove that D2C is no longer optional for pharma companies with drugs that people actually want.

Every company watching will realize they need their own direct channels or risk being locked out of huge patient populations.

True, the economics only work when your drug has a strong pull-through and the discount to patients generates enough volume to offset the margin reduction.

But for the right products, this could unlock entirely new revenue streams.

While Wegovy changed how we treat obesity, oral sema is about to change how we sell drugs.

Five years from now, every big debut will launch with telehealth partnerships, cash-pay channels, and formulary strategies that treat PBMs as one option among many.

Another shift we can thank GLP-1s for.

**The views, opinions, and recommendations expressed in this essay are solely my own and do not represent the views, policies, or positions of my employer or any other organization with which I am affiliated. This content is provided for informational purposes only and should not be considered medical, legal or investment advice.**

Oo interesting! What are your thoughts on Novo Nordisk and Eli Lilly now both using 9amHealth and Form Health as their telehealth partners?

Interesting! I agree that Novo having a head start on approval for an oral glp1 drug gives them an advantage in creating and retaining that market. I do still suspect though that some large percentage of DTC customers would be willing to switch to whatever drug, oral or injectable, is cheaper if it was a $100/month+ difference, which creates the space for DTC price competition.