What Comes After the GLP-1 Hype?

It's messy, unglamorous stuff involving patients and insurers and crystal balls for pharma

If I see another TAM slide predicting GLP-1s being a $100 billion market by 2030, I might gouge my eyes out. I think I’ve seen some variation of that number at least 47 times this week. We get it. The market is big.

But going forward, the more important, more pressing questions are i) how the hell are we going to get people on treatment and then stop them from cycling on and off again? ii) what are the ripple effects of having a drug like GLP-1 in the market?

I found three stories this week that have some answers for us.

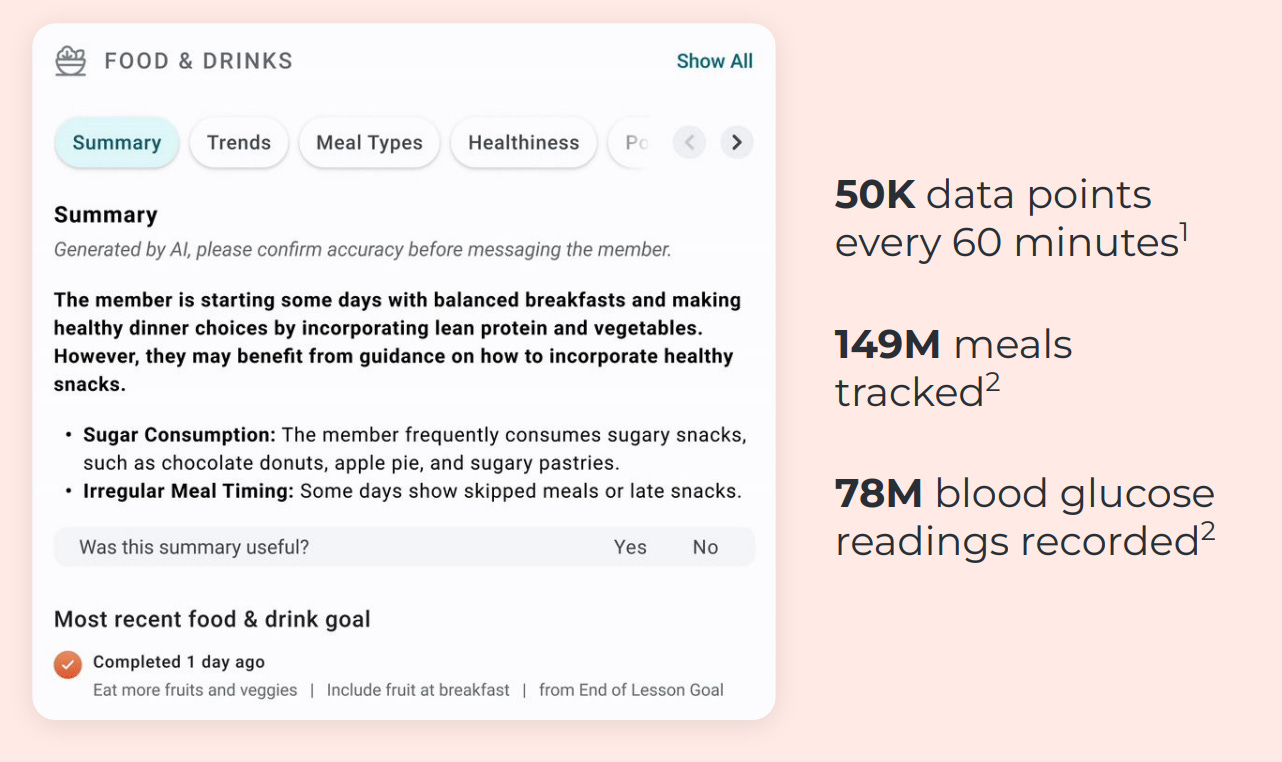

Most GLP-1 coaching apps function like content libraries that don’t inspire real behaviour change. Not Omada’s GLP-1 care track program, though.

Through its companion app, Omada achieves 94% retention at 12 weeks and 84% at 24 weeks, which is far, far above the typical rates of 40-80% and 33-74% respectively. The first thought that came to mind was: have they fudged the numbers?

No, I don’t think they have, because they’ve used pharmacy refill rates alongside customer surveys to back the claim.

So, I dug into how they’re pulling this off and how it compares to other apps on the market I’ve seen, and I found their formula for success to be very simple and very smart:

They align the program to what predicts outcomes, not engagement. When their analysis showed video lesson completion was a weak predictor of weight loss, they stopped rewarding it. Instead, they put the emphasis on immediate coach contact in week one and steady peer engagement because those behaviours drive weight loss and retention.

They use AI to spot members who might quit and then have real coaches jump in with perfect timing. Messages like “Hey, missed you at weigh-in yesterday — want a quick reset plan?” are simple, but they work and are way better than those annoying generic app notifications we all tend to ignore.

These data-driven insights and proactive messages are just some examples of how Omada is leveraging its growing data advantage. With 100k+ GLP-1 members and PBM partnerships giving them access to 100M+ covered lives, Omada is building a powerful moat.

As members persist longer on therapy, Omada collects more behavioral data, which improves their AI models, which drives better retention, which generates more data... and you get the picture.

From a financial perspective, I expect them to get aggressive about pushing routine interactions (meal planning, onboarding, basic check-ins) to AI. That should meaningfully compress their COGS since human coach time (I imagine) is their biggest expense right now.

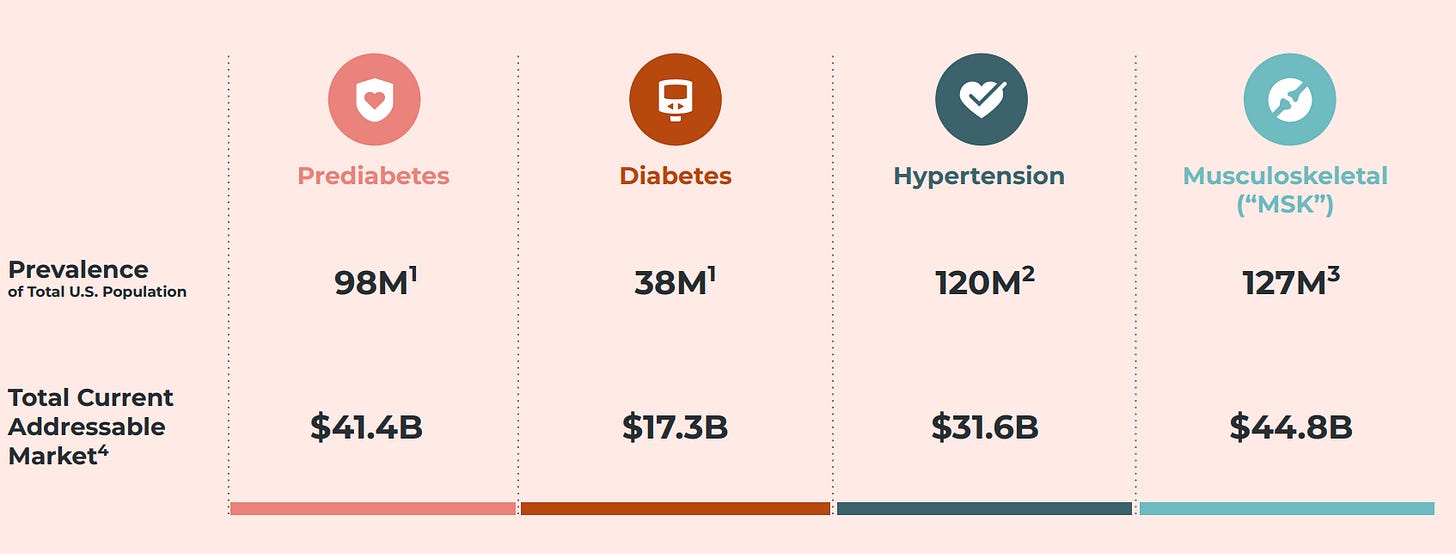

They’re also playing a smart platform game.

Omada helps over 700k patients with MSK, diabetes and hypertension through similar digital programmes which give them leverage as each condition has significant overlap with the other.

The obvious play is gearing up to sell employers one contract that covers the entirety of chronic care conditions on one single platform, rather than purchasing disjointed services from different providers that lack data interoperability.

More conditions = more recurring revenue per customer = better unit economics. Not only do I think it’s brilliant, I am also extremely bullish on their approach. If I were an investor, I’d keep both eyes on them.

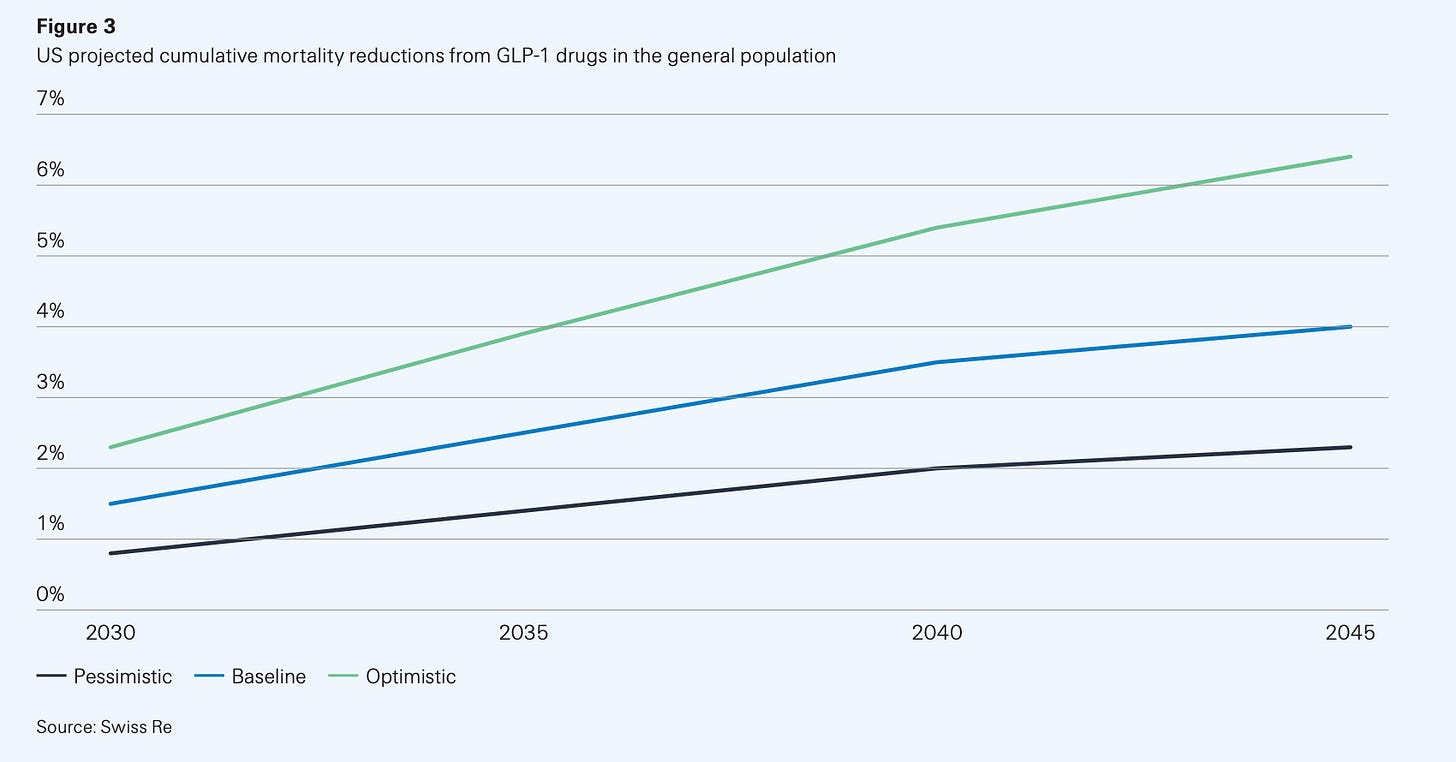

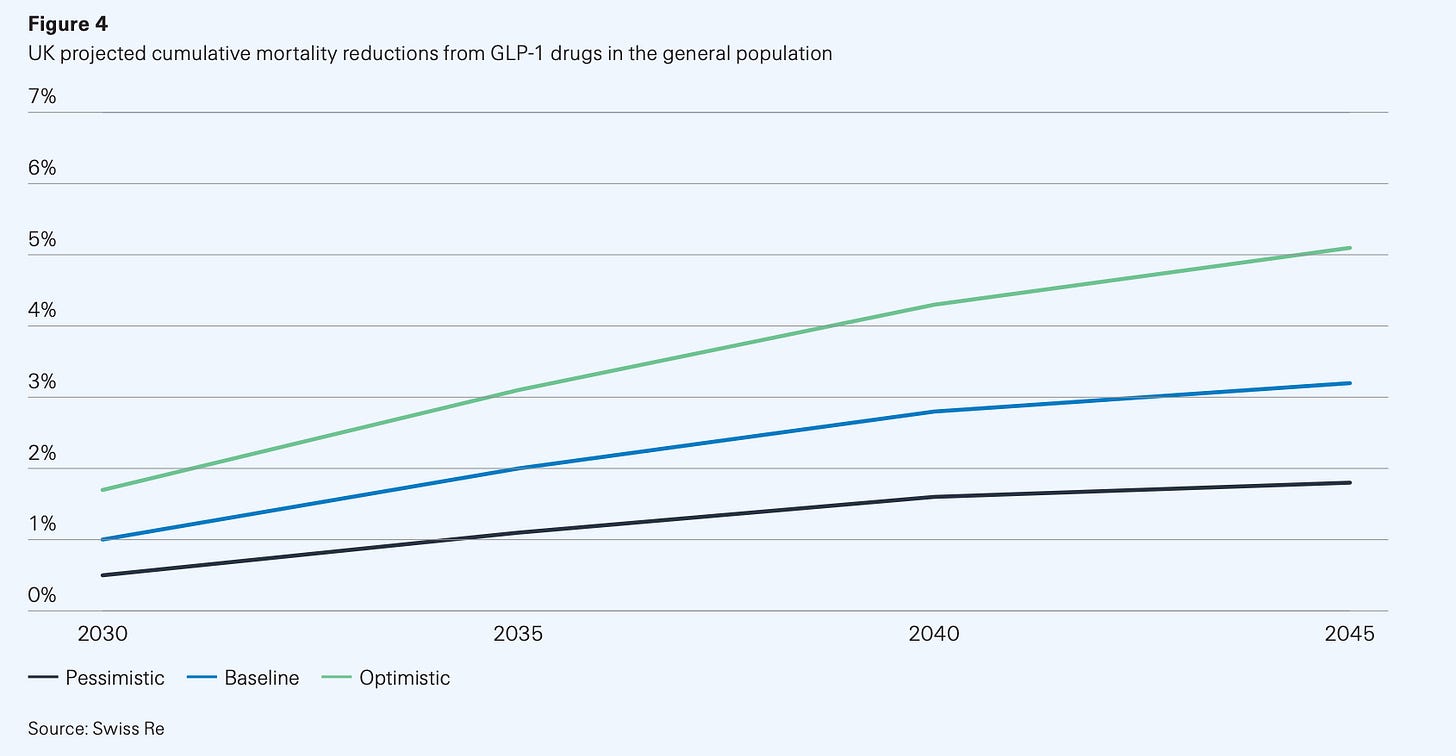

GLP-1s could be the first drug class to reshape national life expectancy curves. Swiss Re, one of the world’s biggest reinsurers, recently modelled three scenarios for GLP-1 uptake and persistence in the US and UK.

By 2045, the US could see up to a 6% reduction in deaths if the drugs are widely used and people stay on them (optimistic). Even in a baseline scenario, mortality falls about 4%. For context, most public health interventions struggle to move that curve by even a single, tiny percent!

The figures are slightly more conservative in the UK, whose population starts at a slightly better baseline BMI than our American brethren. Mortality reduction peaks at about 5% under optimistic assumptions and is closer to 3% in the baseline.

Now, let’s say if everyone prescribed a GLP-1 stayed on it and those best-case mortality gains actually materialized, a very interesting problem arises. We’d see longer lifespans (how long we live) and healthspans (how long we stay healthy), and while that’s a clear public health victory, it presents a very complex challenge for pension funds and annuity providers as longer and healthier lives mean longer and longer payouts.

This creates what the industry calls “longevity risk.”

Without innovations in wealth span (how long our money lasts), we may be creating a society that cannot financially sustain itself as people outlive their savings. But of course, this longevity crisis only matters if we solve the persistence problem first.

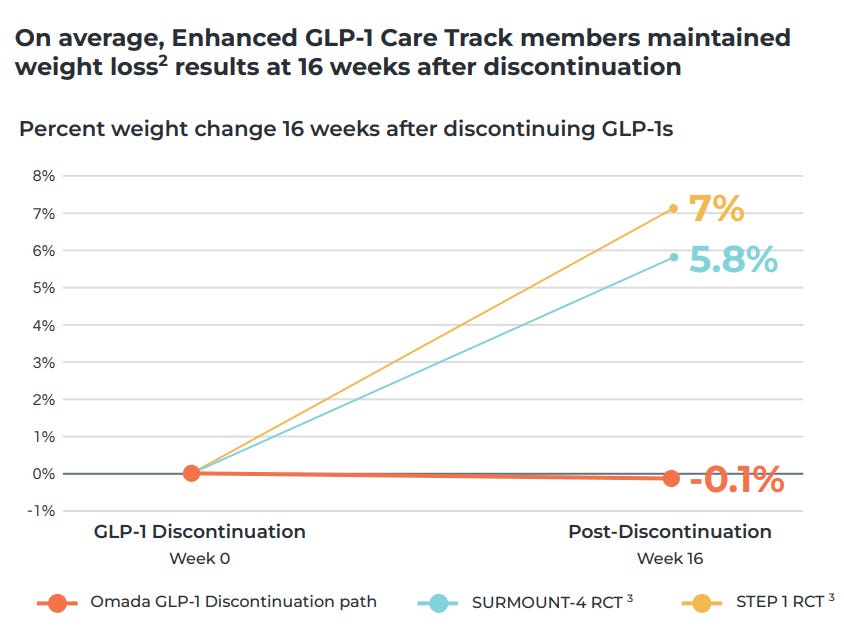

We’re seeing people start and stop GLP-1s frequently — a pattern similar to yo-yo dieting. Data even shows a seasonal pattern to the yo-yoing, with more people starting treatment in winter and stopping in summer and creating a pattern that suspiciously looks like New Year’s resolution gym memberships.

The problem is that this on-again-off-again approach could be dangerous.

While we don’t have long-term studies yet, repeatedly gaining and losing weight probably isn’t good for the body. I’d even go out on a limb and say that repeated weight regain may actually worsen cardiovascular and metabolic health.

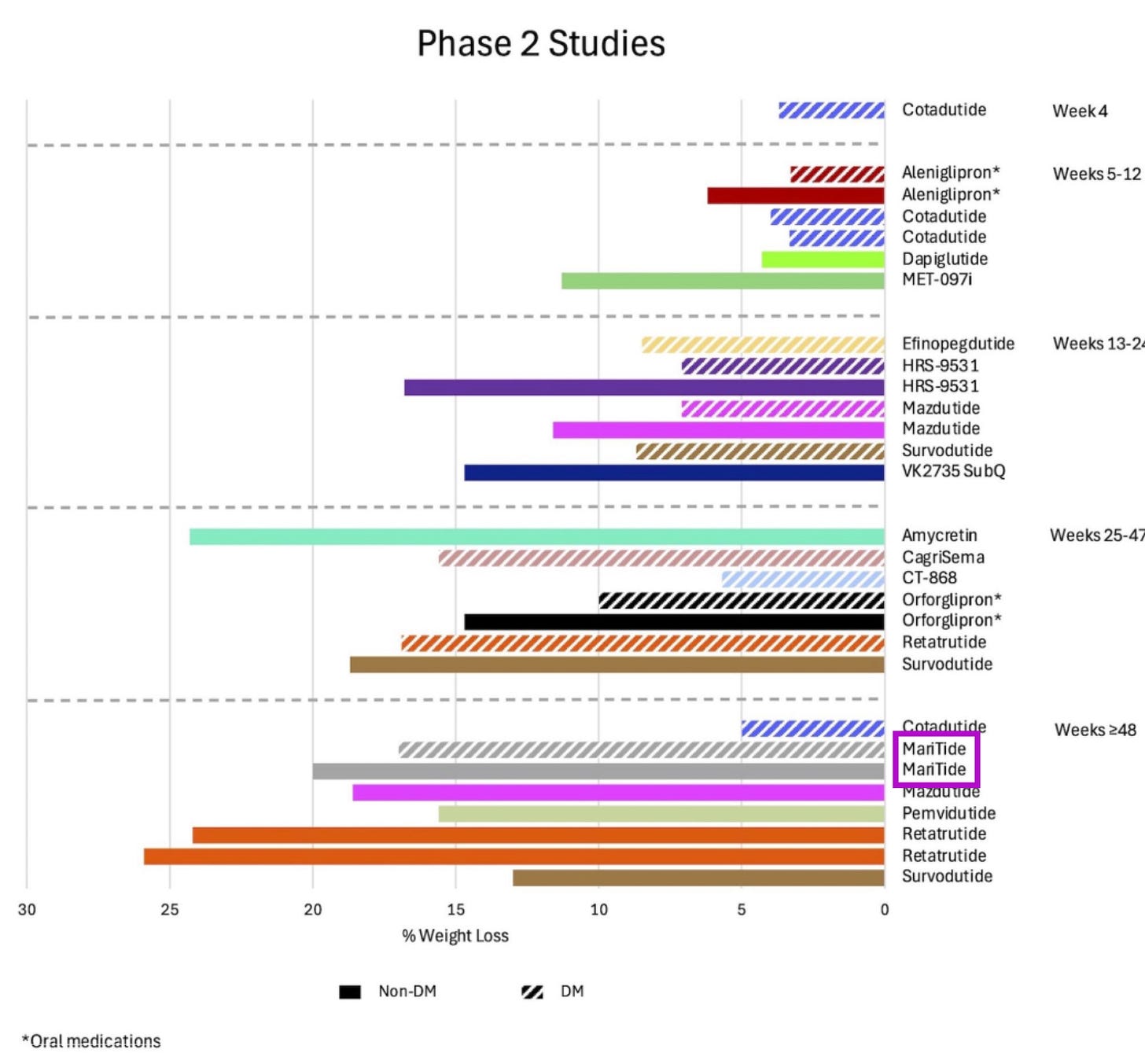

One thing at a time, though! Long-acting GLP-1s — monthly injections instead of weekly — could reduce decision fatigue and make persistence a lot easier.

It’s 12 decisions you need to make instead of 54 for injections and 365 for daily tablets. I’m particularly excited about Maritide, Amgen’s monthly injectable, which has shown positive read outs in Phase 2 trials — I’m confident they’ll deal with the GI side effects and tolerability with adjusted dosing.

As for the longevity risk, insurers and policymakers will find creative ways to make sure people die on schedule.

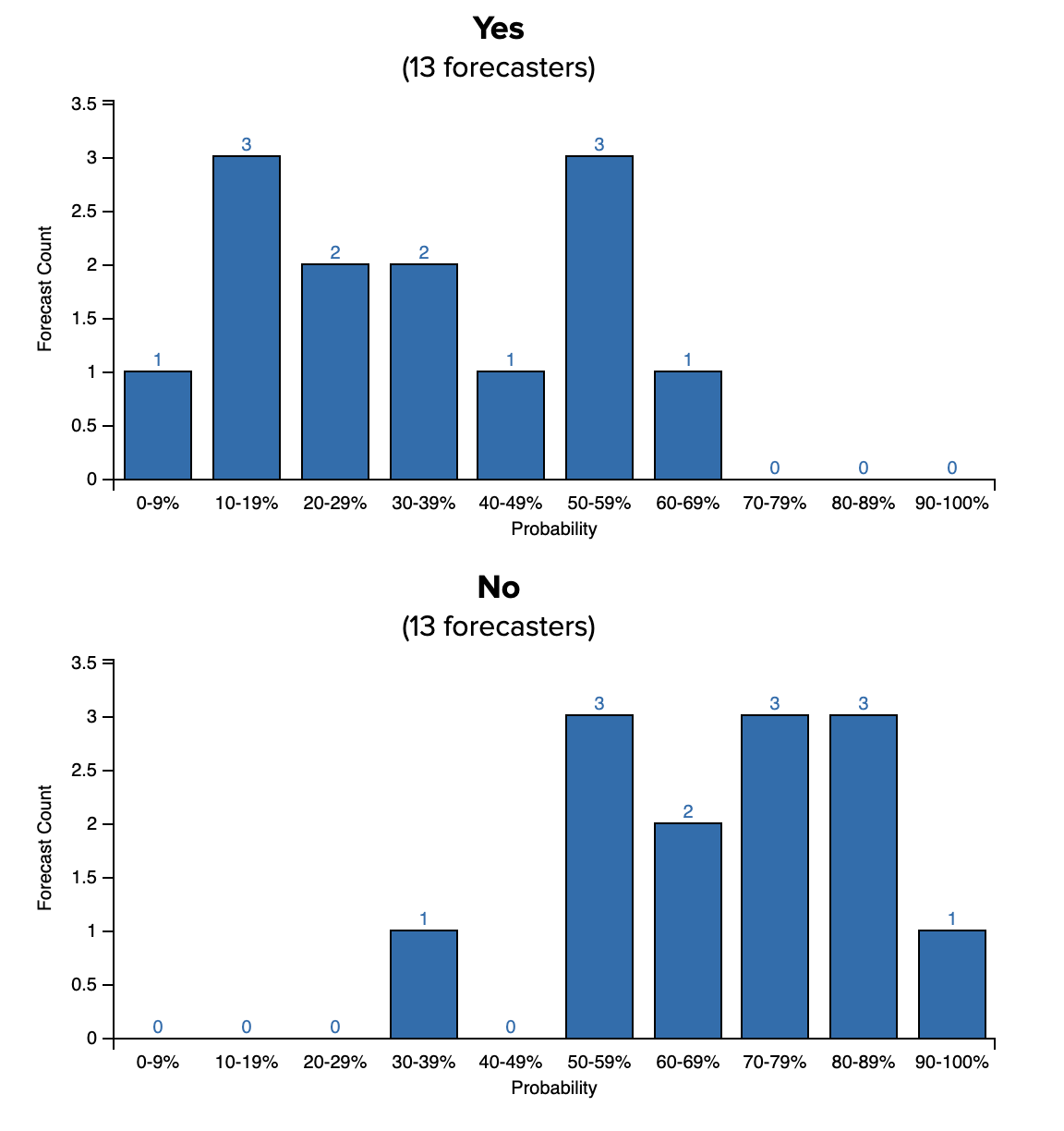

Pharma needs its own Polymarket and I’ll die on this hill. I recently wrote about Novo’s EVOKE trials testing whether oral semaglutide (Rybelsus 14mg) slows the progression of Alzheimer’s disease.

EVOKE is powered to detect ~20% slowing on CDR-SR, and I’m confident it’ll be a positive read out.

Yes, you can call me out if it fails, but I’d even go so far as to say that’s unlikely because even a ~10–15% slowing of disease would still be clinically meaningful given sema’s safety profile and pricing compared to the super-expensive anti-amyloid drugs on the market.

Interestingly, when I was looking into overall market sentiment around EVOKE, I found a Polymarket-style prediction forecast, and the odds are basically split 50:50. Firstly, this is awesome. Secondly, imagine if every Phase 3 trial had a public prediction market. We’d be able to see:

Which trials insiders actually believe in (watch where pharma employees bet)

Real-time sentiment shifts when competitive data drops

Better capital allocation (investors could hedge trial risk directly)

Honest probabilities instead of binary “will it work?” speculation

The FDA and pharma companies would definitely hate this idea. But for an industry that claims to be ‘data-driven,’ we’re weirdly comfortable making multi-billion dollar decisions based on investor decks that say “we remain confident in our pipeline”.

Give me the transparent odds.

**The views, opinions, and recommendations expressed in this essay are solely my own and do not represent the views, policies, or positions of my employer or any other organization with which I am affiliated. This content is provided for informational purposes only and should not be considered medical, legal or investment advice.**

The most important thing in GLP1s will be the price medicare negotiates in the next month or so.

Also keeping my peepers on MariTide - I strongly suspect people will prefer the monthly dosing by injection over the new orals wrt convenience - even though I hear a lot of “oh people will definitely want the pills when they come out”

Another cracker of an article 🤌