Trump's announcement shifts competition in the GLP-1 market

Who will benefit, and who won’t?

I swear to god. Every time Trump announces something on GLP-1s, I have to stop everything, clear my drafts, and reformulate my thesis on the market. Last week was no different.

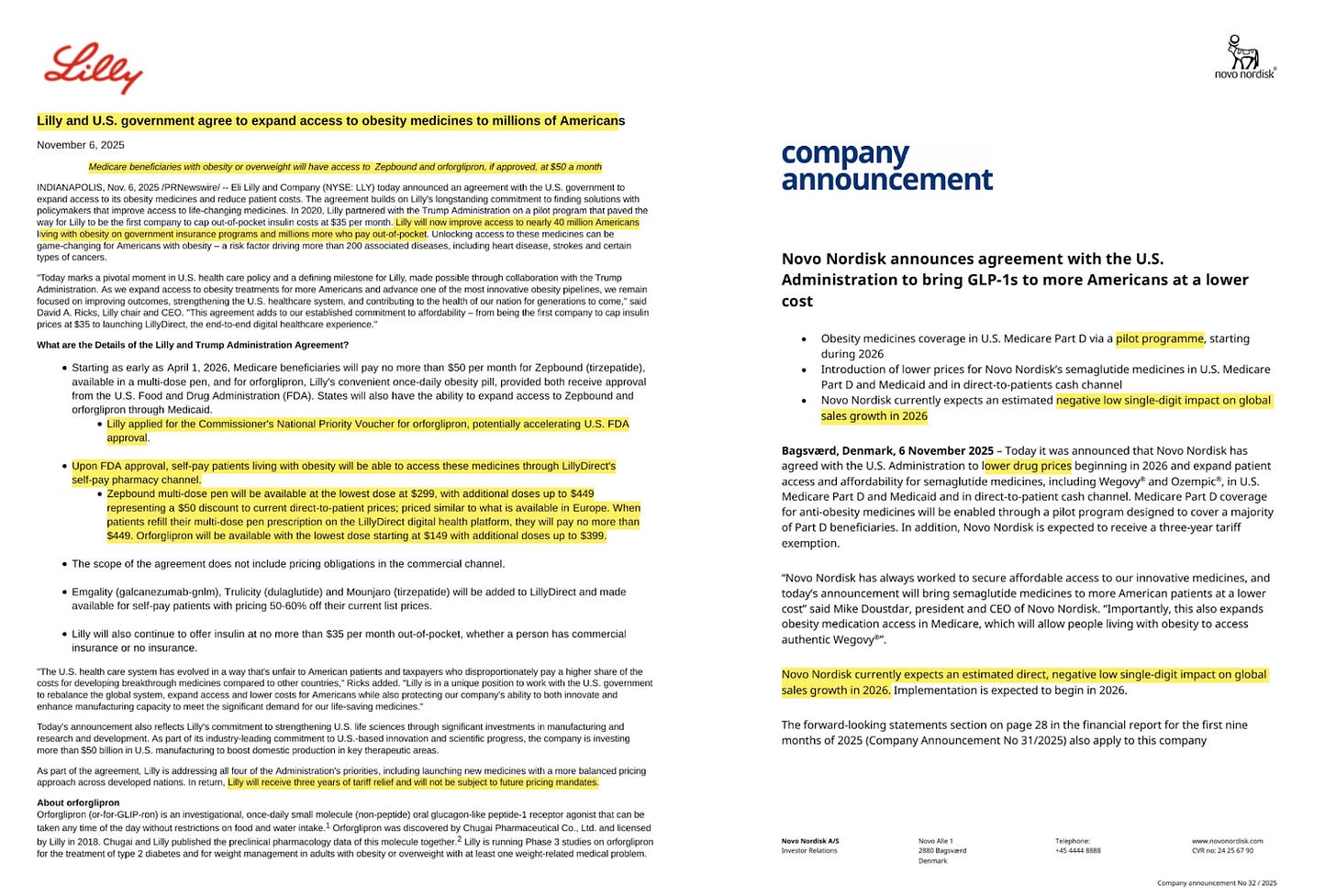

On November 6, the Trump administration announced pricing agreements with Eli Lilly and Novo Nordisk to expand Medicare and Medicaid coverage for GLP-1s, along with deals for the newly minted TrumpRX cash pay channel. Most commentary has alluded to this as a win for pharma and a small win for patients.

I disagree. I think this deal is a blowout victory for Eli Lilly, a devastating loss for Novo Nordisk, and a sizable win for patients. Let me explain why.

But first, this edition is proudly brought to you by Light-it.

If you’re building a GLP-1 or weight-management startup, I’m about to save you six months of pain.

Most dev shops will nod along when you explain telehealth workflows, then come back three weeks later with a patient portal that violates HIPAA in five different ways. Or they’ll build your prescription routing system without understanding why pharmacy integrations aren’t just API calls.

I’ve watched and heard this happen enough times that when someone asks me for a dev shop recommendation in this space, there’s only one name I give them: Light-it.

They know the GLP-1 D2C space intimately- from onboarding flows and async visits to prescription routing, insurance checks, and refill reminders – they’ve helped multiple D2C telehealth companies ship products that work at scale, from MVP to series B and beyond.

The result?

You skip the expensive learning curve and start shipping products that actually work in clinical settings from day one.

Building in health tech?

What the Medicare/Medicaid deal actually means

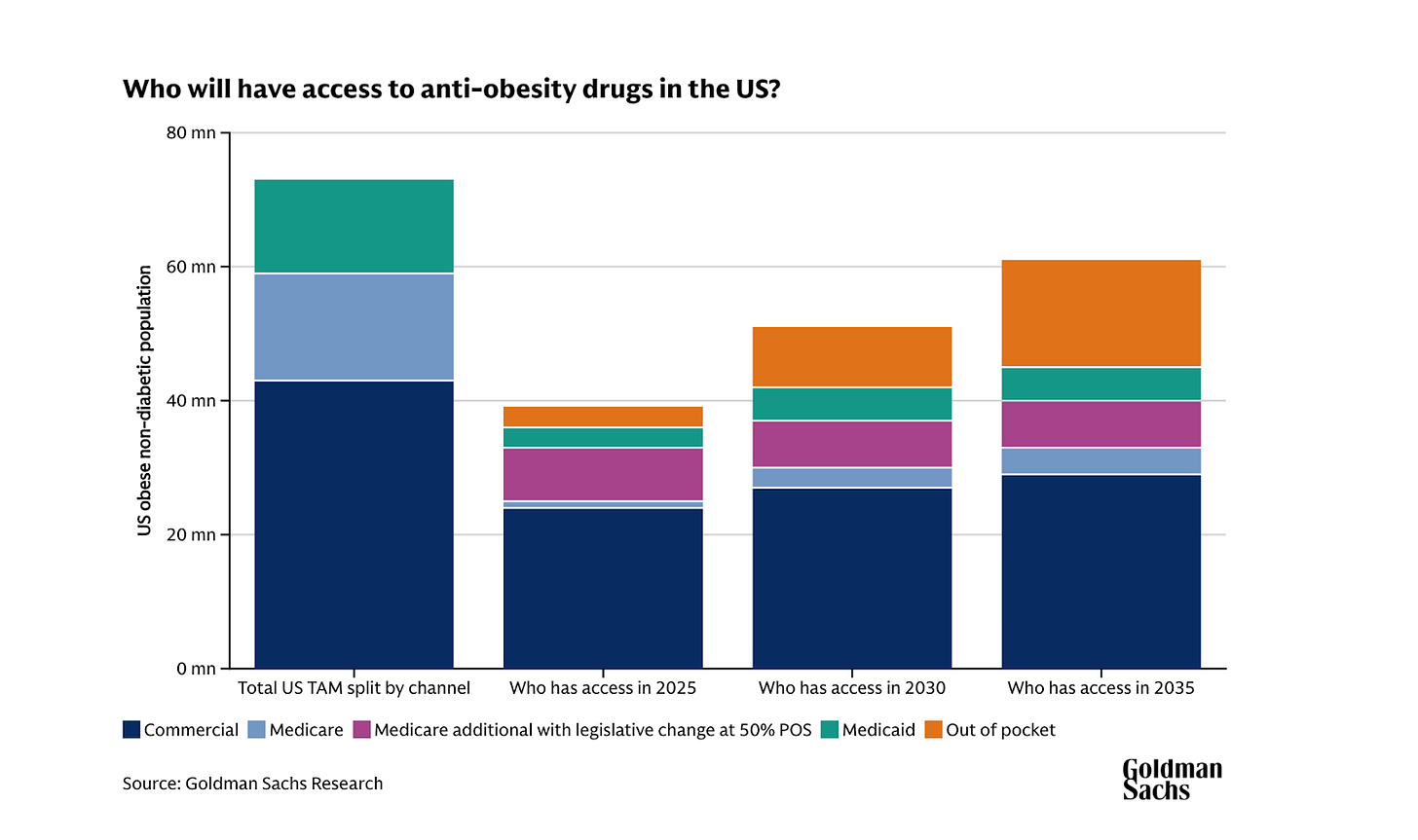

Medicare and Medicaid represent one of the largest untapped volume opportunities in the GLP-1 market. Lilly estimates roughly 40 million people will gain new access to anti-obesity medications, assuming every state opts into Medicaid coverage and every Medicare Part D plan participates.

In my view, the deal is worth the price erosion because of the size of the opportunity we’re talking about. Unlocking 40 million people is massive. That’s almost two-thirds of the population of the UK, all on a GLP-1. This is especially true for Lilly, which I expect will take the lion’s share of this channel at Novo’s expense.

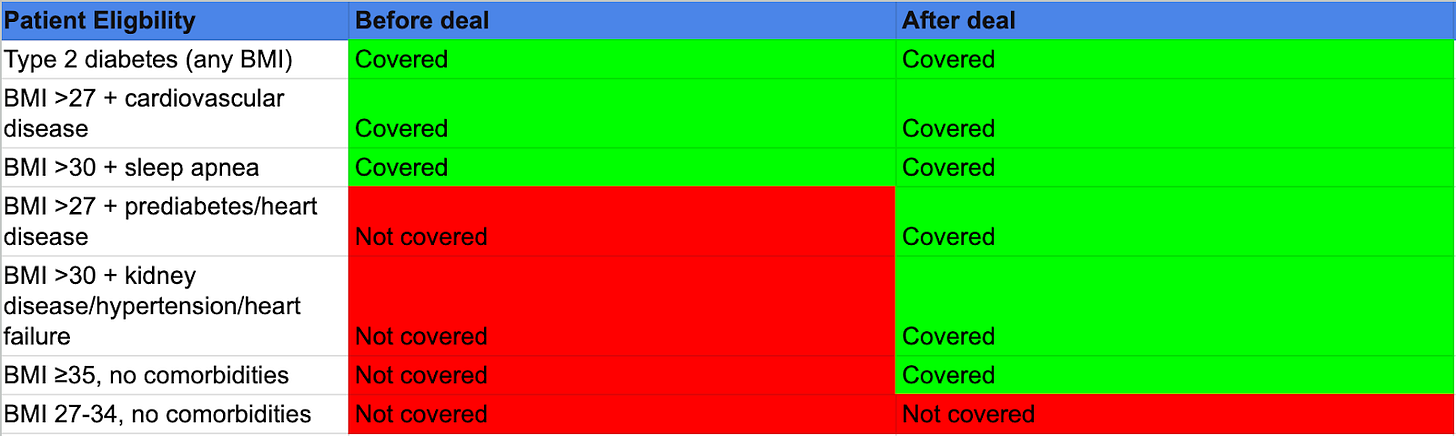

To understand why, let’s start with what actually changed. Medicare Part D already covers overweight/ obesity with certain comorbidities — cardiovascular disease for Wegovy and sleep apnea for Zepbound.

This new deal adds more comorbidities to the eligible list (prediabetes, kidney disease, heart failure, hypertension) and creates one new pathway: severe obesity (BMI ≥35) without requiring any comorbidities.

The eligibility requirements look restrictive, but I think they’re actually well-targeted.

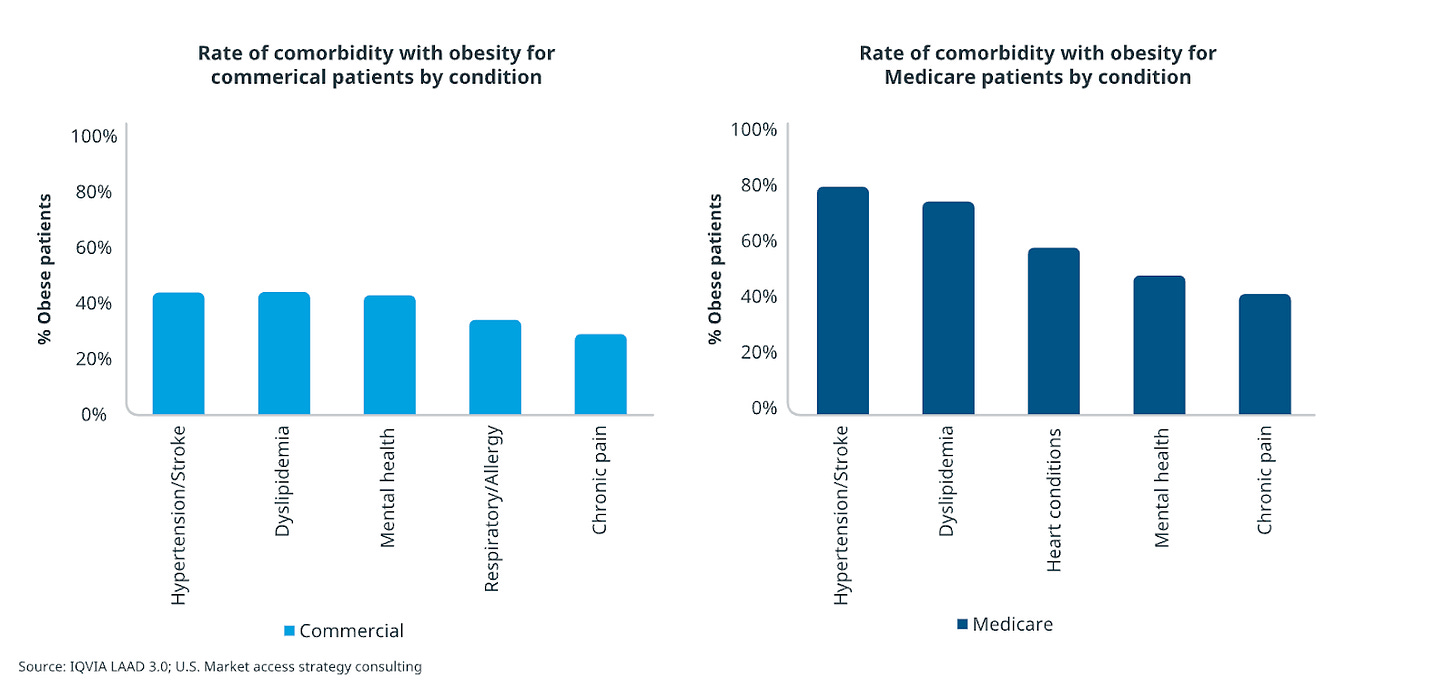

IQVIA analysis shows Medicare patients have significantly higher rates of obesity-related comorbidities compared to insured populations. Hypertension, cardiovascular disease, kidney disease, and prediabetes are extremely prevalent in the 65+ age group. This makes sense given that as patients with obesity age, their risk of accumulating chronic conditions nearly doubles by the time they reach Medicare eligibility!

This means that while the deal requires specific comorbidities or BMI ≥35, it pretty much captures the majority of clinically appropriate Medicare obesity patients because few reach 65 with obesity and no qualifying conditions.

The economics of the deal are pretty sweet, too. Both Wegovy and Zepbound will cost $245/month with a $50 copay, down from current net prices of around $520-700/month.

And in all fairness, the gov’t is getting a good deal. The Trump administration expects roughly 10% of Medicare/Medicaid beneficiaries living with obesity to gain immediate access, which is roughly an extra 4-6 million people on a GLP-1 in the next year or two.

However, what’s important to note is that Medicare coverage will run as a pilot program and isn’t guaranteed just yet. Participation remains voluntary for Medicare health plans — Eli Lilly CEO David Ricks said he expects “almost all” plans to participate, but some may opt out.

Making this permanent requires Congressional action because there’s a law prohibiting Medicare from covering GLP-1s for weight loss (nothing’s ever easy!).

If the pilot proves fiscally sensible through reduced hospitalizations and complications, Congress probably has a foundation for making it permanent.

When it comes to Medicaid, more details need to be published on how it’ll work, but Medicaid plans are state-controlled and opt-in at $245/month. Novo reported in their Q3 earnings call that some states were expected to drop GLP-1 coverage because of current net pricing, so the new negotiated price will push more states to expand coverage.

This means Lilly’s expectation of ~ 34 million new patients through Medicaid is reasonable.

Price parity hands Lilly the advantage

Because Medicare Part D plans can cover both drugs equally, it removes those pesky formulary barriers—the insurance obstacles that make one drug harder to access even when both are “covered.”

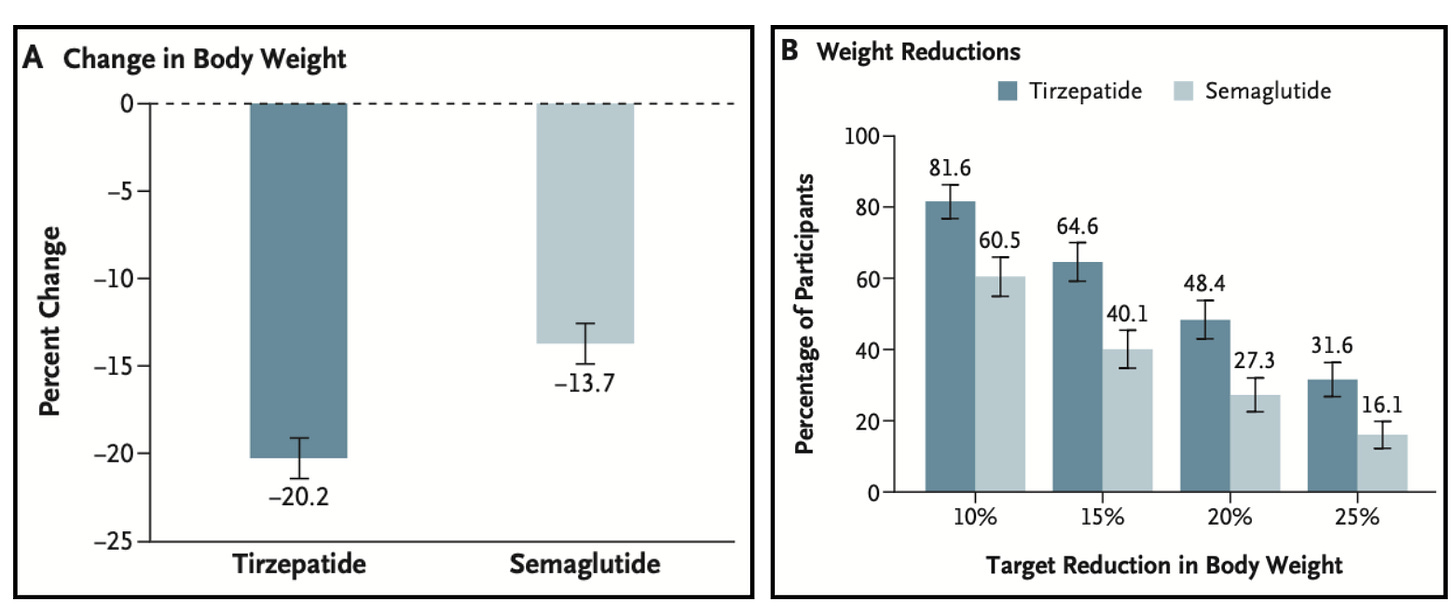

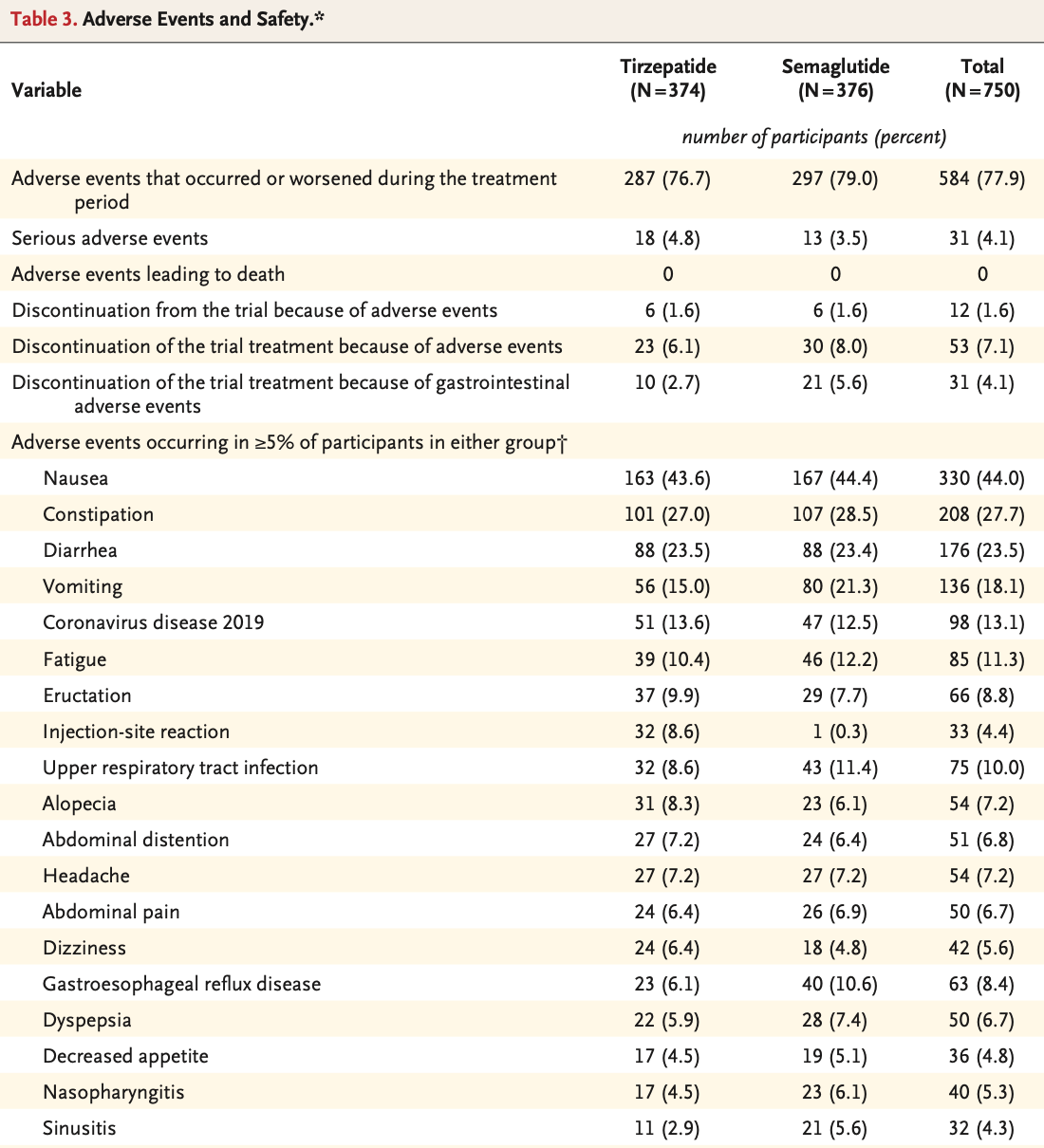

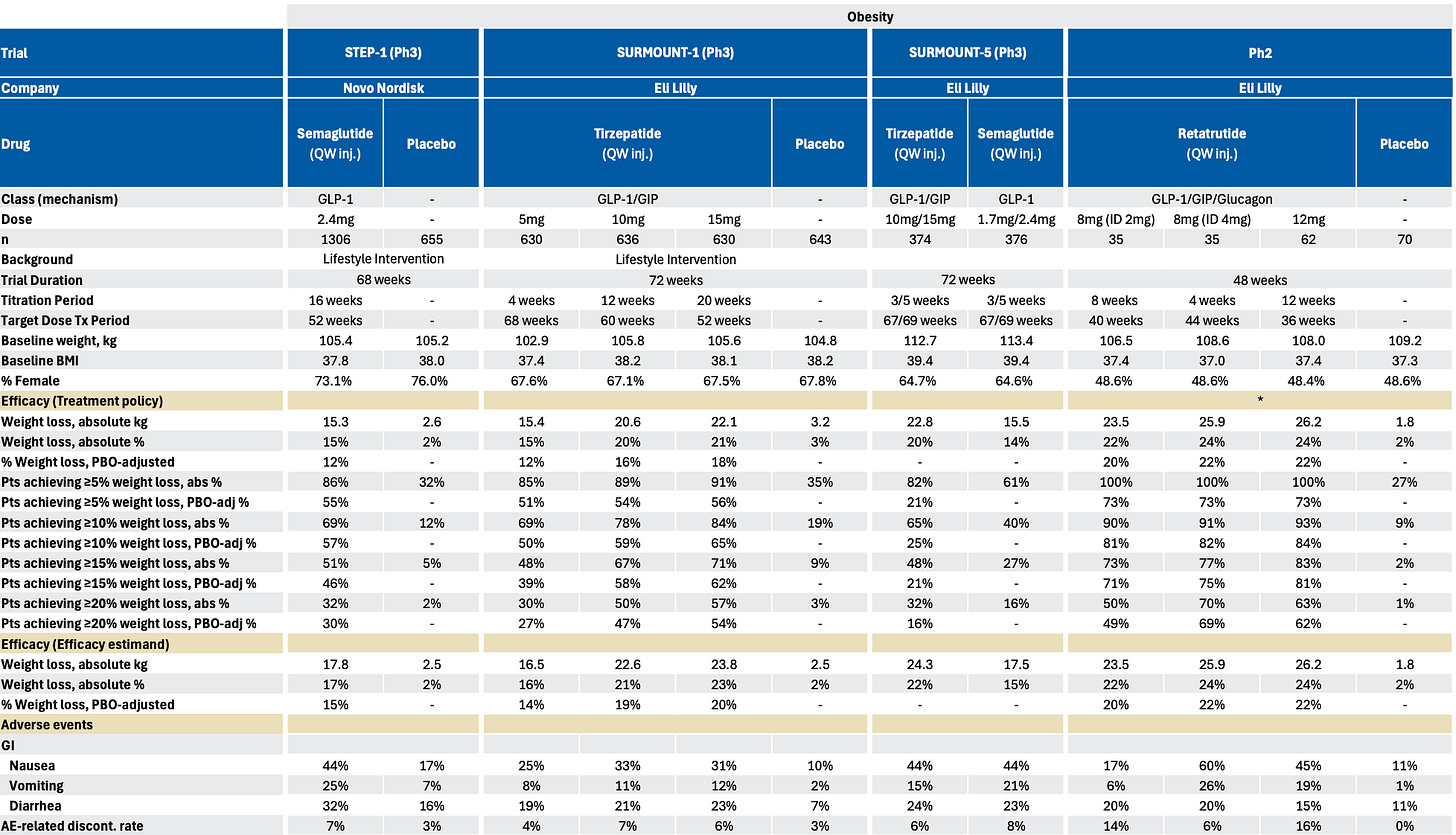

In my view, this sets up tirzepatide perfectly: it delivers better weight-loss outcomes with lower GI discontinuation rates in head-to-head trials in SURMOUNT-5.

The positive results should enable Lilly to win an outsized market share in the US. Evidence of this is already visible internationally—roughly 75% of Mounjaro’s obesity sales come from out-of-pocket channels where patients choose based on therapeutic preference.

Additionally, the tolerability advantage of tirzepatide is particularly important for Medicare’s older population, who typically manage multiple chronic medications. GI side effects like nausea and vomiting interact poorly with cardiovascular drugs, diabetes medications, and antihypertensives that these patients are probably already taking.

I expect physicians prescribing in Medicare will favor the drug that has lower GI side effects and is less likely to create medication management problems that require patients to stop therapy.

It’s also worth remembering that Lilly’s portfolio advantage extends beyond tirzepatide.

Because Trump’s agreement covers future obesity drugs, Lilly can bring orforglipron and retatrutide into an open-access channel.

Orforglipron targets the exact Medicare sweet spot — patients who have type 2 diabetes and obesity. The medication will be extremely sticky in this population group, as I argued a few months ago, mainly because it doesn’t require empty stomach administration or waiting periods before taking other medications, like with Rybelsus/oral semaglutide.

Retatrutide represents an even longer-term competitive advantage. Phase 3 readouts from TRIUMPH-4 are expected soon, and early signals suggest weight loss outcomes exceeding both CagriSema and Wegovy 7.2mg.

One consultant endocrinologist, whom I spoke to and is involved in the trials, described the efficacy data as ‘incredible’.

Neither of Novo’s pipeline responses match retatrutide’s weight loss efficacy: CagriSema carries tolerability concerns from the amylin component, while Wegovy 7.2mg shows higher GI adverse events than the approved 2.4mg dose.

By the time Novo brings meaningful competition, Lilly will have established a three-drug portfolio in the gov’t channel that rewards clinical superiority.

The divergence between the companies’ fates is mirrored in their communications as well.

Lilly’s announcement emphasizes expanding access and “game-changing” opportunities for millions of Americans. Novo’s announcement opens by stating that they “expect an estimated negative low single-digit impact on global sales growth in 2026.”

That negative guidance is very telling. Novo’s low single-digit % impact accounts for both price erosion and expected volume uplift. If they anticipated capturing meaningful market share in Medicare/Medicaid, volume growth would offset the pricing hit.

Lilly’s cash pay strategy targets compounders

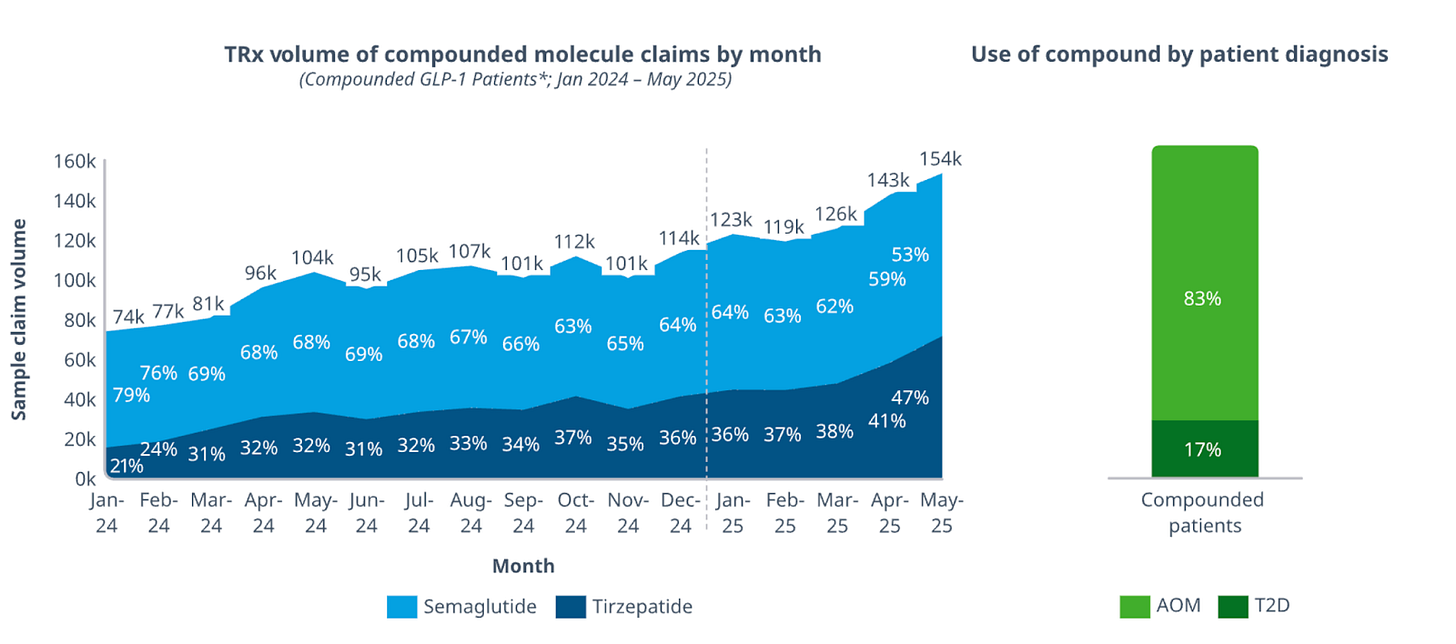

Over recent months compounded trizepatide has been steadily growing, and while Lilly is downplaying the impact these formulations are having on total sales, Novo has been relatively upfront about the data, which they’ve stated now shows over 1 million people using compounded GLP-1s instead of branded versions.

Last week, I argued the compounding market is here to stay because of FDA non-enforcement and judge rulings in favour of compounding pharmacies and telehealth platforms. My thesis still stands, but now I think Lilly is using price competition to target the compounding market instead.

Zepbound will be available through LillyDirect’s cash pay channel at $299/month for the lowest dose (2.5mg multi-dose pen) and up to $449/month for higher doses.

The average price across doses will be approximately $346/month.

Compounded tirzepatide currently ranges from $197 to $359/month, depending on the provider. Mochi Health charges $278 for the lowest doses, while Shed charges $279/month.

I expect significant volume migration from compounded to branded tirzepatide as patients realize the price differential no longer justifies the potential quality trade-off that’s been highlighted by the FDA (despite the green list).

This sets up a pricing war between pharmaceutical manufacturers and compounding pharmacies.

The White House indicated that cash-pay prices should decline from the current $350/month average to $245/month over the next 24 months. As branded pricing compresses, compounders will need to reduce their own pricing to maintain the cost advantage that drives patient selection.

This inevitably creates margin pressure on compounding pharmacies. Compared to semaglutide, tirzepatide is more expensive to source as an API, given its dual-agonist complexity, which limits how much compounders can reduce pricing while maintaining profitability.

As the branded-compounded price gap narrows from $150-200/month to potentially $50-100/month, I think many patients will pay the premium for a pharmaceutical-grade product. That’s also why you’re seeing the rise of microdosing programmes with lower-BMI eligibility from D2C players- essentially a marketing play to offset tightening unit economics.

In this case, the dynamics really do favour Lilly, and I expect the compounded tirzepatide market to shrink meaningfully over the next two years as pricing converges.

The other winning deal

Lilly’s oral GLP-1, orforglipron, will launch at $149/month for starting doses and up to $399/month for higher doses, averaging around $346/month. This is exactly what I predicted two months ago when I estimated orforglipron’s net cash-pay price would land between $150-300/month.

More importantly, the pricing confirms my thesis that Lilly would maintain price parity between orforglipron and Zepbound to enable market segmentation rather than cannibalization.

The strategy works on two levels. First, orforglipron’s small molecule structure means manufacturing costs are substantially lower than oral semaglutide, which uses nearly 10x the API dose with an absorption enhancer. At $149 for starting doses, I expect Lilly will maintain healthy margins while Novo COGS for oral sema may feel the squeeze.

More importantly, Lilly secured a Commissioner’s National Priority Review Voucher for orforglipron, accelerating FDA approval to Q1 2026.

This was a key competitive win buried in the details!

Novo was counting on a first-mover advantage, with oral Wegovy expected to launch in Q1 2026. The assumption was that 3-6 months of exclusivity in the oral space was enough to build brand recognition and capture market share before orfor arrived. Lilly’s priority voucher now eliminates that window.

If orforglipron launches simultaneously or shortly after oral Wegovy, Novo now loses the positioning advantage they’ve been building toward.

Novo gets squeezed in cash pay

Novo’s cash-pay strategy is really puzzling to me. Both Ozempic and Wegovy are priced at $350/month through TrumpRx, with flat pricing across the dose titration schedule. In my view, this represents a missed opportunity to apply pricing pressure on the compounded semaglutide market.

Compounding pharmacies like Hims & Hers currently offer compounded semaglutide at approximately $199/month. The $150 price gap between Novo’s branded product at $350/month and compounded alternatives means price-conscious patients have little incentive to switch.

The result is that compounded semaglutide will survive as a viable market segment while compounded tirzepatide faces compression.

Novo appears to be prioritizing margin preservation over market share capture in the cash-pay channel, and it may reflect their view that they can’t capture meaningful volume with this new deal, even with aggressive pricing. So they’re optimizing for profitability on whatever share they do retain rather than fighting a pricing war they don’t expect to win.

But these dynamics only matter if commercial insurers, who control the majority of volume, don’t blow up the entire market structure.

Commercial Spillover

Government pricing creates a reference price, while Medicare and cash pay will now create the floor.

Once Medicare and Medicaid pay $245/month, that number becomes the reference price for the entire market. While the deal explicitly excludes “pricing obligations in the commercial channel,” commercial insurers will surely begin to ask: “Why are we paying $520-700 net price when the government pays $245?”

Morgan Stanley’s analysis of Eli Lilly has lowered 2026/2027 revenue estimates for Zepbound and Mounjaro, expecting commercial prices to converge toward government prices over time. For Zepbound, they model the US blended net monthly price declining from $594 currently to $475 in 2026, $390 in 2027, and $308 by 2030.

For Mounjaro, $397 in 2026, $337 in 2027, and holding at $337 in 2030.

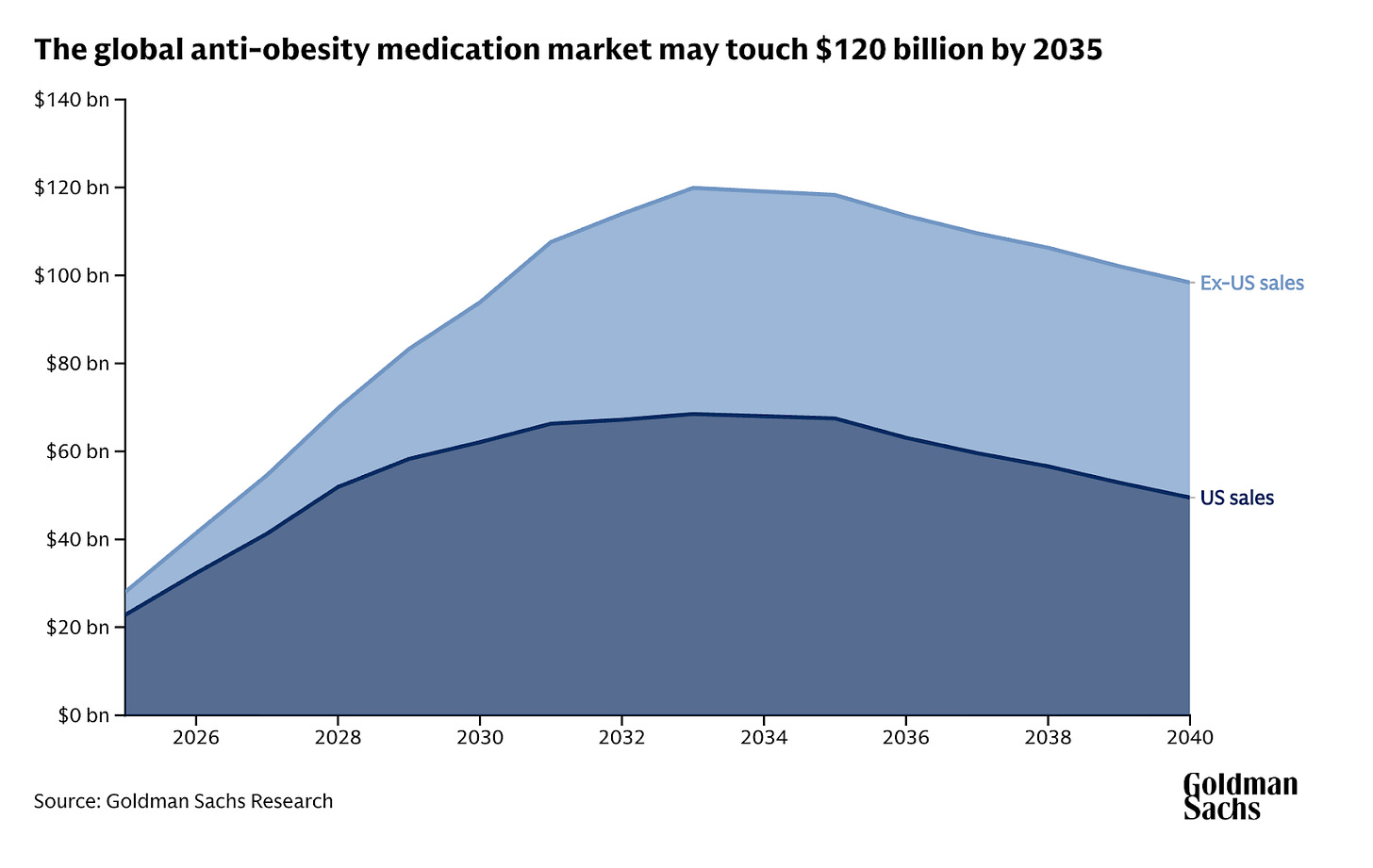

This gradual decline in net price per prescription over time means that Goldman Sachs’ analysis of their obesity market forecast was ultimately right. Price erosion will reduce the global market size of obesity by 2030 from $130 billion globally to $95 billion, with US peak sales down from $95 billion to $70 billion.

But, as I argued last week, lower net prices in the commercial channel don’t necessarily solve the coverage problem. Even at $245/month, covering all eligible obesity patients would cost commercial insurers tens of billions annually and financially cripple them.

Therefore, I expect coverage to remain patchy and an increasing use of prior authorizations and step therapy to restrict uptake, regardless of how low prices drop in the near term.

Conclusion

Ultimately, this deal is a clear win for Lilly and sour grapes for Novo.

I expect the American pharma giant to capture the majority of market share in the gov’t channels due to the clinical superiority of its drug portfolio. I’m convinced that Novo’s negative sales guidance tells you everything about who expects to capture share.

For patients, this represents meaningful progress. Roughly 4-6 million Medicare/Medicaid beneficiaries gain access to anti-obesity medications under expanded comorbidity criteria, with another 34 million becoming potentially eligible through state Medicaid programs.

Yes, it’s currently opt-in, but as a first step, this moves millions of patients from no access to some access.

Now, I just hope Trump will let the competition and this sleep-deprived writer settle before making another announcement.

**The views, opinions, and recommendations expressed in this essay are solely my own and do not represent the views, policies, or positions of my employer or any other organization with which I am affiliated. This content is provided for informational purposes only and should not be considered medical, legal or investment advice.**

Curious if you know how effective Pharma counter-messaging to patients against compounded GLP-1 has been? I know there has been some via formal channels, but it doesn't feel significant, or perhaps is too early. Perhaps they also look to turn up the volume on the "do you really know what you're injecting in your body" type fear messaging in addition to price cuts.